- What’s not wrong with libertarianism? (pdf) Tom Palmer, Critical Review

- A civilizational foreign policy? Samuel Gregg, Modern Age

- The case against fiscal austerity? Ed Dolan, Open Society

- The minimum wage paper that needs to be written Vincent Geloso

fiscal policy

Nightcap

- Lessons from World War I and British Grand Strategy John Bew, War on the Rocks

- Trump prefers spectacle to strategy Danny Sjursen, the American Conservative

- A better way to talk about politics Conor Friedersdorf, the Atlantic

- It’s not just about big government Scott Sumner, theMoneyIllusion

A short note on Rand Paul’s shaming of the GOP

For those who don’t know what I’m talking about, Rand Paul delayed a new, 700-page congressional budget that purportedly adds $300 billion to the deficit. CNN has the money shot:

“When the Democrats are in power, Republicans appear to be the conservative party,” Paul said at one point. “But when Republicans are in power, it seems there is no conservative party. The hypocrisy hangs in the air and chokes anyone with a sense of decency or intellectual honesty.”

Read the rest. The delay lasted a couple of hours. What I found most interesting was the complaining, by Senators and House Representatives alike, about having to stay up until 4 or 5 in the morning to pass the budget.

Good. At first I was incensed that politicians could think of nothing other than getting a good night’s sleep after adding hundreds of billions of dollars to the deficit (these are the same people who have voted to give themselves six-figure salaries for their “public service”), but then I remembered, thanks in part to Rick’s constant reminders, to give my enemies all my faith. Washington’s politicians probably believe they are doing honest work, and that adding to the already massive deficit is okay as long as it achieves a bipartisan consensus.

One other thought: Rand Paul is playing politics when he uses the term “conservative” to describe budget discipline. He knows, like Jacques, that conservatives are unprincipled, middle-of-the-road opportunists, but in today’s public discourse, fiscal discipline is somehow associated with conservatism, so he uses the term “conservative” to describe his libertarian politics.

Does anybody know where the deficit actually stands?

The Enforcement Costs of Immigration Laws are Greater than Alleged Welfare Costs

As I mentioned in my note yesterday, the common argument that immigration is significantly costly through welfare is mostly empirically falsified. The fact of the matter is immigrants usually aren’t qualified for such programs, illegal immigrants mostly cannot and do not receive them, and immigrants as a whole wind up contributing more to the government’s balance sheet through economic growth and tax receipts than they take through welfare transfer payments.

However, there is one fact I neglected to mention yesterday worthy of its own post: if those opposed to immigration on the grounds of welfare costs were really sincere in that argument, they also need to consider the fiscal costs of enforcing their beloved immigration laws. As the New York Times editorial board pointed out yesterday, these costs are not insignificant:

The Migration Policy Institute reported in 2013 that the federal government spends more each year on immigration enforcement–through Immigration and Customs Enforcement and the Border Patrol–then on all other federal law enforcement agencies combined. The total has risen to more than $19 billion a year, and more than $306 billion in all since 1986, measured in 2016 dollars. This exceeds the sum of all spending for the Federal Bureau of Investigation; the Drug Enforcement Administration; the Secret Service; the Marshals Service; and the Bureau of Alcohol, Tobacco, Firearms, and Explosives.

These fiscal costs get worse when you consider that Donald Trump wants to expand ICE’s budget even further and, of course, the $8-$12 billion dollar wall.

Further, if you are a civil liberties type concerned with the social and fiscal costs of mass incarceration, immigration enforcement looks even bleaker:

ICE and the Border Patrol already refer more cases for federal prosecution than the entire Justice Department, and the number of people they detain each year (more than 400,000) is greater than the number of inmates being held by the Federal Bureau of Prisons for all other federal crimes.

The war on immigrants makes the war on drugs look tame.

Of course, these costs are pretty small when compared to the welfare state, but immigrants are not the ones driving up those welfare costs and they might even reduce it with more tax receipts. The truth is that furthering immigration restrictions and enforcement is truly fiscally irresponsible, not respecting the right to freedom of movement and contract.

Would a Universal Basic Income Increase Poverty?

Switzerland has recently overwhelming voted against a proposal that would establish a universal income guarantee (sometimes called a “basic income guarantee” or the similar Friedman-influenced “negative income tax”[1]). Though I myself am a supporter of BIG as a nth best policy alternative for pragmatic reasons,[2] I’m unsure if I myself would have voted for this specific policy proposal due to the lack of specifics. A basic income is only as good as the welfare regime surrounding it (which preferably would be very limited) and the tax system that funds it.[3] However, the surprising degree of unpopularity of the proposal—with 76.9% voting against—was quite surprising.

The Swiss vote has renewed debate in the more wonkish press and blogosphere, as well as in think tanks, about the merits and defects of a Basic Income Guarantee here in the States. For example, Robert Goldstein of the Center on Budget Policy and Priorities[4] has a piece arguing that a BIG would increase poverty if implemented as a replacement for the current welfare state. His argument covers three points:

- A BIG would be extremely costly to the point of being impossible to fund.

- A BIG would increase the poverty rate by replacing current welfare programs like Medicaid and SNAP.

- A universal welfare program like a BIG—as opposed to means-tested programs—is politically impossible right now due to its unpopularity.

For this post, I’ll analyze Goldstein’s arguments in detail. Overall, I do not find his arguments against a BIG convincing at all.

The Political Impossibility of a BIG

Goldstein writes:

Some UBI supporters stress that it would be universal. One often hears that means-tested programs eventually get crushed politically while universal programs do well. But the evidence doesn’t support that belief. While cash aid for poor people who aren’t working has fared poorly politically, means-tested programs as a whole have done well. Recent decades have witnessed large expansions of SNAP, Medicaid, the EITC, and other programs.

If anything, means-tested programs have fared somewhat better than universal programs in the last several decades. Since 1980, policymakers in Washington and in a number of states have cut unemployment insurance, contributing to a substantial decline in the share of jobless Americans — now below 30 percent — who receive unemployment benefits. In addition, the 1983 Social Security deal raised the program’s retirement age from 65 to 67, ultimately generating a 14 percent benefit cut for all beneficiaries, regardless of the age at which someone begins drawing benefits. Meanwhile, means-tested benefits overall have substantially expanded despite periodic attacks from the right. The most recent expansion occurred in December when policymakers made permanent significant expansions of the EITC and the low-income part of the Child Tax Credit that were due to expire after 2017.

In recent decades, conservatives generally have been more willing to accept expansions of means-tested programs than universal ones, largely due to the substantially lower costs they carry (which means they exert less pressure on total government spending and taxes).

I agree that Goldstein is right on this point: universal welfare programs are extremely unpopular right now, like the Swiss vote shows. I imagine that if a proposal were on the ballot in the States the outcome would be similar.[5] However, this is no argument against a Basic Income. Advocating politically unpopular though morally and economically superior policies is precisely the role academics and think tank wonks like Goldstein should take.

If something is outside the Overton Window of Political Possibilities, it won’t necessarily be so in the future if policymakers can make the case for it effectively to voters and the “second-hand dealer of ideas” in think tanks and academia get their ideas “in the air,” so to speak.[6] It wasn’t that long ago that immigration reform or healthcare reform seemed politically impossible due to its unpopularity, yet the ladder has popular support and the former was actually accomplished.[7]

If anything, the unpopularity of a BIG is precisely why people like Goldstein should advocate for the policy.

The Fiscal Costs of Funding a Basic Income Guarantee

Goldstein points out, rightly, that a Basic Income Guarantee would be extremely expensive:

There are over 300 million Americans today. Suppose UBI provided everyone with $10,000 a year. That would cost more than $3 trillion a year — and $30 trillion to $40 trillion over ten years.

This single-year figure equals more than three-fourths of the entire yearly federal budget — and double the entire budget outside Social Security, Medicare, defense, and interest payments. It’s also equal to close to 100 percent of all tax revenue the federal government collects.

Or, consider UBI that gives everyone $5,000 a year. That would provide income equal to about two-fifths of the poverty line for an individual (which is a projected $12,700 in 2016) and less than the poverty line for a family of four ($24,800). But it would cost as much as the entire federal budget outside Social Security, Medicare, defense, and interest payments.

Where would the money to finance such a large expenditure come from? That it would come mainly or entirely from new taxes isn’t plausible. We’ll already need substantial new revenues in the coming decades to help keep Social Security and Medicare solvent and avoid large benefit cuts in them. We’ll need further tax increases to help repair a crumbling infrastructure that will otherwise impede economic growth. And if we want to create more opportunity and reduce racial and other barriers and inequities, we’ll also need to raise new revenues to invest more in areas like pre-school education, child care, college affordability, and revitalizing segregated inner-city communities.

Of course, Goldstein is right that a BIG would be fairly expensive and we are already having serious issues funding our existing welfare state. However, he grossly oversells the difficulty in funding it. In particular, it is not necessary to raise taxes to pay for it or for current welfare expenditures.

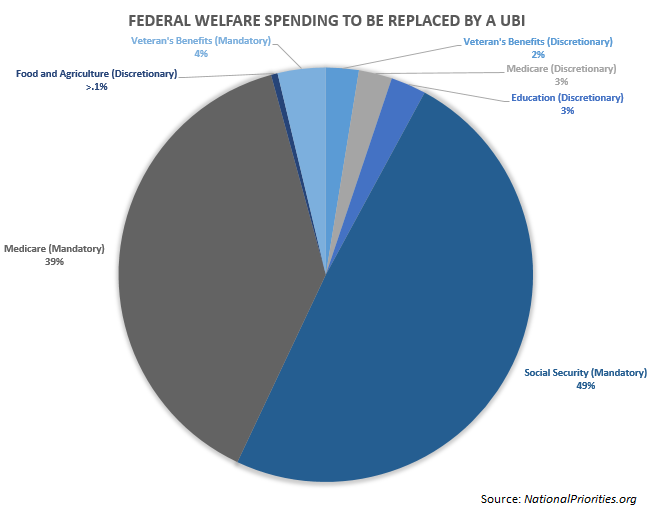

Goldstein likely gets the $10,000 figure from Charles Murray’s proposal for a BIG. Personally, I’m no fan of Murray’s proposal as it goes too far and he proposes financing it by increasing payroll taxes, which are economically inefficient. However, let’s assume that the relevant proposal is around $7,000 dollars.[8] Multiplying that by the US population of 320 million makes for a total cost $2.24 trillion per year.[9] This could be paid for by using the BIG to replace the following current welfare programs and cutting discretionary spending:[10]

- $65.32 billion annually in discretionary spending on Veteran’s benefits

- $66.03 billion in discretionary spending on Medicare and other healthcare benefits

- $69.98 billion in discretionary spending for education.[11]

- $13.13 billion in discretionary spending for food and agriculture (eg., SNAP).[12]

- $1.25 trillion in mandatory spending for Social Security.[13]

- $985.74 billion in mandatory spending for Medicare and Healthcare.

- $95.3 billion in mandatory spending for veteran’s benefits.[14]

That’s a total of $2.542 trillion in savings annually, more than enough to fund the proposed BIG with another $300.3 billion to spare that could be used for tax credits for low-income households to use on healthcare,[15] education,[16] retirement,[17] and/or basic necessities like food.[18] Funding the program would be a huge challenge, but it is possible to do it without tax increases.

Additionally, Goldstein ignores the fact that similar proposals, such as Friedman’s negative income tax, would have a much lower cost while having a similar effect. The Niskanen Center’s Samuel Hammond has estimated that a NIT could cost only $182 billion annually.[19] From Hammond’s analysis:

Just how much of a cost difference is there between a UBI and NIT? To get a rough idea, I used the Census population survey’s Annual Social and Economic Supplement, which has the distribution of individuals over the age of 15 by income level in $2,500 intervals (I subtracted retirees). I then calculated the transfer each quantile would receive based on a hypothetical NIT which starts at $5,000 for individuals with zero income and is phased out at a rate of 30%. Multiplying the average transfer by the number of actual individuals in each grouping and summing, I arrived at total cost of $182 billion—roughly the combined budget for SSI, SNAP and EITC.

The Effect of Replacing Welfare with a BIG on Poverty

Goldstein would object to my line of reasoning by saying cutting all that spending would harm the poor and increase the poverty rate. He says as much in his piece:

UBI’s daunting financing challenges raise fundamental questions about its political feasibility, both now and in coming decades. Proponents often speak of an emerging left-right coalition to support it. But consider what UBI’s supporters on the right advocate. They generally propose UBI as a replacement for the current “welfare state.” That is, they would finance UBI by eliminating all or most programs for people with low or modest incomes.

….Yet that’s the platform on which the (limited) support for UBI on the right largely rests. It entails abolishing programs from SNAP (food stamps), which largely eliminated the severe child malnutrition found in parts of the Southern “black belt” and Appalachia in the late 1960s, the Earned Income Tax Credit (EITC), Section 8 rental vouchers, Medicaid, Head Start, child care assistance, and many others. These programs lift tens of millions of people, including millions of children, out of poverty each year and make tens of millions more less poor.

Some UBI proponents may argue that by ending current programs, we’d reap large administrative savings that we could convert into UBI payments. But that’s mistaken. For the major means-tested programs — SNAP, Medicaid, the EITC, housing vouchers, Supplemental Security Income (SSI), and school meals — administrative costs consume only 1 to 9 percent of program resources, as a CBPP analysis explains. Their funding goes overwhelmingly to boost the incomes and purchasing power of low-income families.[20]

Moreover, as the Roosevelt Institute’s Mike Konczal has noted, eliminating Medicaid, SNAP, the EITC, housing vouchers, and the like would still leave you far short of what’s needed to finance a meaningful UBI. Would we also end Pell Grants that help low-income students afford college? Would we terminate support for children in foster care, for mental health, and for job training services?

This is by far and away the weakest part of Goldstein’s argument.

First of all, as my analysis above showed, Konczal’s and Goldstein’s idea that eliminating the current welfare state “would still leave you far short of what’s needed to finance a meaningful UBI” is just false. Even a relatively robust UBI of $7,000 a year is doable by significantly cutting current welfare programs.

But more importantly, Goldstein’s assertion that replacing the welfare state with a UBI would increase poverty is fully unwarranted. He seems to take a ridiculously unsophisticated idea that “more means-tested programs immediately reduce welfare.” His assertion that the programs in question “lift tens of millions of people, including millions of children, out of poverty each year and make tens of millions more less poor” is, at best, completely erroneous. For three reasons: first, individuals know better what they need to lift themselves out of the than the government, and these programs assume the opposite. Second, the structure of status quo means-tested programs often creates a “poverty trap” which incentivizes households to remain below the poverty line. Finally, thanks to these first two theoretical reasons, the empirical evidence on the success of the status-quo programs in terms of reducing the poverty rate is, at best, mixed.

The way our current welfare state is structured is it allocates how much money can go to what basic necessities for welfare recipients. So if a household gets $10,000 in welfare a year, the government mandates that, say, $3,000 goes to food, $3,000 goes to healthcare, $3,000 goes to education, and $1,000 goes to retirement.[21] This essentially assumes that all individuals and households have the same needs; but this is simply not the case, elderly people may need more money for healthcare and less for education, younger people may need the exact opposite, and poorer families with children may need more for food and education than other needs. It’s almost as if our current welfare system assumes interpersonal utility function comparisons are possible, or utility functions of poorer people are fairly homogenous but they’re not. It also ignores the opportunity cost of the funding for helping individuals and households out of funding; a dollar spent on healthcare may be more effectively spent on food for a particular individual or household.

In sum, there’s a knowledge problem involved in our current welfare policy to combat poverty: the government cannot know the needs of impoverished individuals, and such knowledge is largely dispersed, tacit, and possessed by the individuals themselves. The chief merit of a UBI is, rather than telling poor people what they can spend their welfare on, it just gives them the money and lets them spend it as they need.

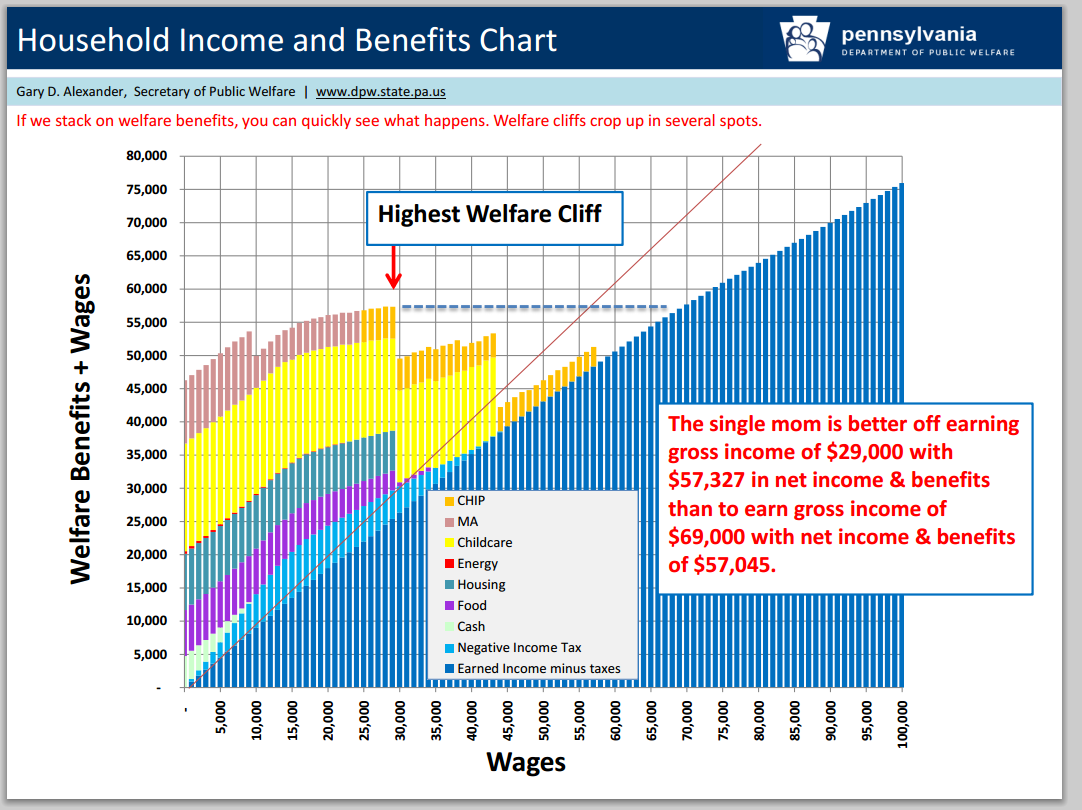

Second, universal programs are superior to means tested programs precisely because the amount of transfer payments received does not decrease as income increases. Our current welfare programs too often make the marginal cost of earning an additional dollar, above a certain threshold, higher than the benefits because transfer payments are cut-off at that threshold. This actually perversely incentivizes households to remain in poverty.[22] For example, the Illinois Policy Institute while analyzing welfare in Illinois found the following:

A single mom has the most resources available to her family when she works full time at a wage of $8.25 to $12 an hour. Disturbingly, taking a pay increase to $18 an hour can leave her with about one-third fewer total resources (net income and government benefits). In order to make work “pay” again, she would need an hourly wage of $38 to mitigate the impact of lost benefits and higher taxes.

Or consider this chart (shown above) from the Pennsylvania Department of Public Welfare showing the same effect in Pennsylvania

UBI does not suffer from this effect. If your income goes up, you do not lose benefits and so there are no perverse incentives at work here. Ed Dolan has analyzed how the current welfare state with its means-tested benefits is worse in terms of incentivizing work and alleviating poverty extensively. Here’s a slice of his analysis:

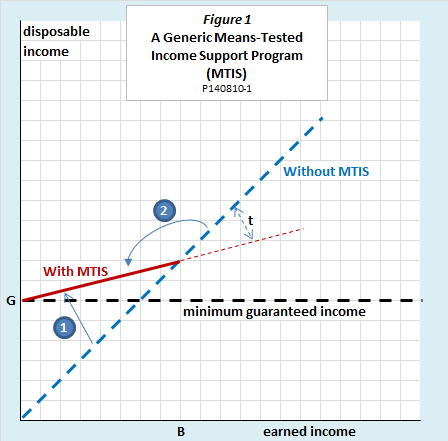

The horizontal axis in Figure 1 represents earned income while the vertical axis shows disposable income, that is, earned income plus benefits. To keep things simple, we will assume no income or payroll taxes on earned income—an assumption that I will briefly return to near the end of the post. The dashed 45o line shows that earned and disposable income are the same when there are no taxes or income support. The solid red line shows the relationship between disposable and earned income with the MTIS policy.

This generic MTIS policy has three features:

A minimum guaranteed income, G, that households receive if they have no earned income at all.

A benefit reduction rate (or effective marginal tax rate), t, indicted by the angle between the 45o line and the red MTIS schedule. The fact that t is greater than zero is what we mean when we say that the program is means tested. As the figure is drawn, t = .75, that is, benefits are reduced by 75 cents for each dollar earned.

A break-even income level, beyond which benefits stop. Past that point, earned income equals disposable income.

When these two factors are taken into account (that individuals know better than the government what they need to get out of poverty and there are significant poverty traps in our welfare state), it is no surprised that the empirical evidence on the effectiveness of these anti-poverty programs is far less rosy than Goldstein seem to think.

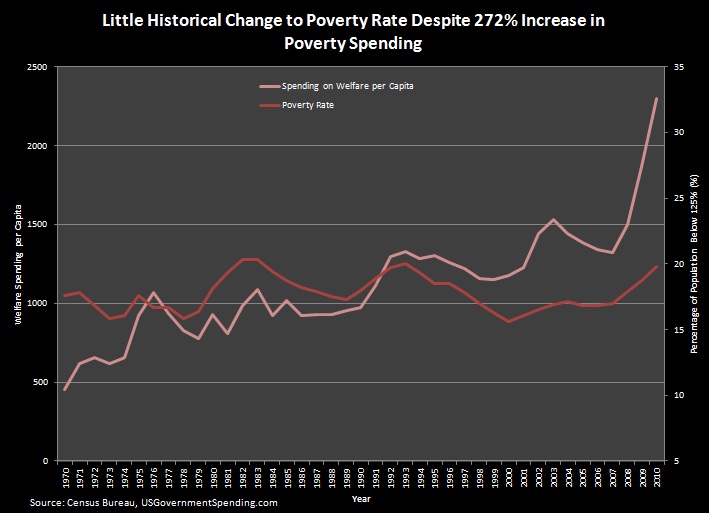

After reviewing the empirical literature on the relationship between income and welfare improvements for impoverished households, Columbia University’s Jane Waldfogel concluded “we cannot be certain whether and how much child outcomes could be improved by transferring income to low income families.” The Cato Institute’s Michael Tanner wrote in 2006:

Yet, last year, the federal government spent more than $477 billion on some 50 different programs to fight poverty. That amounts to $12,892 for every poor man, woman, and child in this country. And it does not even begin to count welfare spending by state and local governments. For all the talk about Republican budget cuts, spending on these social programs has increased an inflation-adjusted 22 percent since President Bush took office.

Despite this government largesse, 37 million Americans continue to live in poverty. In fact, despite nearly $9 trillion in total welfare spending since Lyndon Johnson declared War on Poverty in 1964, the poverty rate is perilously close to where it was when we began, more than 40 years ago.

Tanner’s point remains true today. The chart below shows that, despite a massive increase in anti-poverty spending since the war on poverty was declared under Johnson’s “Great Society,” Poverty rates have remained woefully stagnant. In fact, the reduction in poverty that was occurring prior to Johnson’s interventions stopped soon thereafter.

Also, the point is that UBI is a replacement for current welfare benefits. Most households probably would not see a decrease in amount of benefits under a UBI, depending on the specifics of the proposal, and some might even see an increase, contrary to Goldstein’s analysis. Further, they’d be able to actually spend this on what they know they need rather than what government bureaucrats thin they need.

UBI lacks the flaws of the current welfare state, and would likely decrease poverty far more effectively than Goldstein thinks, especially when compared to his favored status-quo.

[1] Though there are some technical differences between Milton Friedman’s proposal for a “negative income tax” and most Basic Income Guarantee proposals, they essentially have the same effect on income. See the Adam Smith Institute’s Sam Bowmen on this point.

[2] See Matt Zwolinski for the “Pragmatic Libertarian Case for a Basic Income,” it should be noted that “pragmatic reasons” here does not refer to my pragmatist philosophical views. Zwolinski has also made a moral case for the basic income on Hayekian grounds that a BIG could reduce coercion in labor negations. I am unsure to what extent I am convinced by this line of reasoning, but it is a valid argument nonetheless.

[3] The Niskanen Center’s Samuel Hammond has made the case that universal transfer programs like a Basic Income cannot be analyzed outside of the tax system that pays for it.”

[4] Or, as my think tank buddies jokingly call it, the “Center for Bigger Budgets.”

[5] Having said that, polls have shown that it is popular across the pond in the Eurozone. The Swiss proposal would call into question this point but it could be argued that the vagueness of the Swiss proposal is why it was turned down not necessarily the spirit of it.

[6] My colleague Ty Hicks of Students for Liberty has made this point well. See also Hayek’s “Intellectuals and Socialism.”

[7] Granted, the Affordable Care Act was not really what most on the left or the right wanted in the first place and has been a disaster.

[8] This number is selected because, according to the CBO, $9,000 is the average amount in means-tested welfare benefits per household for 2006. But that’s for households and a BIG discussed here is for individuals, so it is understandable to make a BIG slightly less than the current average. Goldstein would object that this is far below the poverty line, but BIG is not meant to be a replacement for total income on the labor market at all, so it is unclear why this is an objection in the first place.

[9] This is admittedly a crude and naïve calculation but it is virtually identical to the method Goldstein himself uses to estimate the cost.

[10] All figures for this section are for the 2015 budget and are taken from here.

[11] Goldstein is sure not to be happy with cutting education, and I myself would like to replace this spending with few-strings-attached funding for local education or private school tax vouchers. I’ll address this point more later in this piece.

[12] Much of this is food stamps, which would be rendered obsolete by a BIG anyways. Goldstein would object, more on that in the next section.

[13] Not all of this could be cut, and there would be legal and detailed nuances on how to treat financial obligations for Social Security, veteran’s benefits, and Medicare. The specific legal complexities of mandatory welfare spending are not my areas of expertise, admittedly, and is outside the scope of this paper. I’m just illustrating that it is possible to cut at least some of this spending, perhaps even the majority of it, to fund it.

[14] Many people would object to cutting veterans benefits. First of all, BIG could act in place of these benefits

[15] I have in mind expanding tax-exempt Health Savings Accounts here. I also think funding this by eliminating the employer-based deduction would be a step in the right direction and reduce cost fragmentation in the healthcare market, as Milton Freidman argued.

[16] I have in mind a private school taxpayer voucher system like what is in Sweden.

[17] I have in mind something similar to this proposal to reform social security from the Cato Institute.

[18] I have in mind something like the pre-bates proposed in the Fair Tax.

[19] For this reason, I prefer an NIT to a BIG, but I prefer both to our current welfare state.

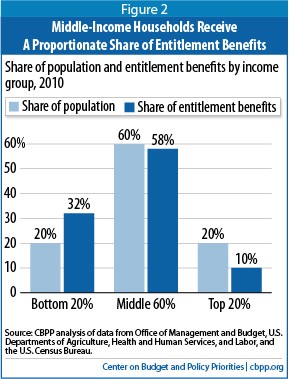

[20] This point is Ironic considering the fact that CBPP’s own research shows that government benefits in America overwhelmingly goes to households above the poverty line, in the middle and upper classes. See this chart (source):

[21] The real-world numbers are probably different and vary a little bit from household to household, but this is just a hypothetical to illustrate a more general point.

[22] It should be noted, however, that the EITC, and some other programs, is largely free of this defect. This is because the EITC itself is modeled after Friedman’s NIT.

Note: The first chart has been edited since this was initially posted for readability.

Percentages that Fairly Scream and, “Catastrophe” is a Greek Word

The WSJ of 7/9/15 shows a comparative table for some European Union countries of spending on pensions as a share of GDP. This comparison denotes roughly the drag effect that payments to retirees has on the whole national economy. To no one’s surprise, Greece tops the list with 14.4%. Germany is at 9.1%. This may seem like a small difference but when it’s turned into actual, absolute figures, the difference becomes downright striking. They scream!

The 5.3 percentage points difference can be applied to both countries’ GDPs (or GDPs per capita, same thing in this case). The International Monetary Fund gives Germany’s GDP per capita for 2014 at about $46,000 and Greece’s at about $26,000*. Pensions cost Germany $4,150 annually for each man, woman and child. Pensions cost Greece $3,400 annually for each Greek. It does not look like the Greeks should be able to afford this kind of disproportionate burden.

Suppose Greece’s pensions took the same bite out of its GDP as Germany ‘s does out of its GDP, 9.1% . In this scenario, today, the Greek economy would have about $1,400 each year unspoken for for each man, woman and child. This money would still be available for spending, as it is through pensions. It would also, however, be available for both public and private investment. That’s $1,400 each year; that’s a lot by any standard. That’s money needed to rejuvenate the Greek aging economic plant.

How realistic would such a change be, involving raising the legal age of retirement, I mean? The Germans’ and the Greeks’ life expectancies are virtually identical ( 80.44 vs 80.30, in CIA Handbook). There seems to be a little wiggle room to move there. Note that raising the age at which people can claim a pension is doubly beneficial: It reduces the number of pensioners while raising the number of workers who support the pensioners. Some will argue that raising the age of retirement is a pipe-dream in a country such as Greece where there is chronically high unemployment. I think this reasoning is wrong. Many Greeks don’t find a job because investment in Greece is insufficient. People need tools to work. What is certain is that the current dishonest Greek government policies, soundly supported by the exercise of a majority of Greeks’ votes cast, are not going to draw foreign investment. The money to improve both Greeks’ chances of employment and their productivity will have to come from within. One significant source is described above: Close the pension option for one or more years to healthy Greeks. It will provide both ready investment money and confidence abroad.

Note that raising the legal age of retirement is a purely political decision. The Greeks can do it any time they want. They can do it overnight. Perhaps, there will soon arise a political party in Greece that will proclaim the truth: It’s not the mean lenders, it’s us!

This is a fairly simplistic reasoning, I know. The general age of the population places constraints on the practicality of raising the age of legal retirement (but an older population also makes it more desirable; think it through). I have heard leftist demagogues on National Public Radio argue that the big bite that pensions take out of the Greek economy is not the Greeks’ fault, that it results more or less directly from the fact that Greece has an old population. Sounds good but the fact is that the Germans are, on the average, quite a bit older than the Greeks (Median age of 46.5 vs 43.5 according to Wikipedia.) Don’t believe experts on NPR, not even on simple facts!

Alternatively, the Greeks could begin collecting their moderate taxes like the Germans instead of like the Italians. They might also remember that “catastrophe” is a Greek word.

* The figures are “PPP” meaning that they take differences in buying power in the two countries into account.

What Ails You, Economy?

The Keynesian is ever mistaking economic activity for economic growth, credit expansion for wealth creation, profligacy for progress. Growth, wealth, progress. He uses his own definitions of each to reinforce his definitions of the others. And they are all fallacious.

When the Austrian tells the Keynesian that the printing and spending of mere pieces of paper cannot lead to more wealth in society, the Keynesian retorts that it is undeniable that credit expansion and stimulus lead to more economic activity. In this he is technically correct. Printing more dollars and handing them out to those who would consume and invest them, does indeed lead to “activity,” even more perhaps than there otherwise would have been.

But our Keynesian assumes, or assumes that his audience will assume, that mere economic activity is growth, is wealth, is progress. Presumably this includes even that activity which our Austrian rightly considers overinvestment (more properly, malinvestment), overconsumption, and/or the proverbial breaking of windows, each of these a common side-effect of the Keynesian witchdoctor’s remedies (often intended to cure ailments caused by earlier interventions, some Keynesian, some not).

If the Keynesian’s definition of economic activity doesn’t (oh, but it does!) include these things then the burden of proof is on him to show that his prescriptions lead to more real growth than would their absence on an unhampered market. And that his incantations lead, on the whole, to economic health rather than disease. A free market is largely unencumbered by the ailments mentioned above so in order to do this it would need to be shown that the sicknesses that do affect it are somehow worse than those caused by intervention.

And to be sure, pure economic freedom isn’t perfect. It has its own share of maladies. But these are all coughs and sneezes by comparison. Cures, if they are needed at all, come from the market itself. The economic meddlers and potion peddlers only serve to make things worse.

We must admit that not even on the most unfettered of markets does all economic activity lead to growth. For human actors err, and the market punishes their errors. How much more is all this the case under a centrally-planned expansionary-monetary/stimulatory-fiscal regime? And how much more severe will be the punishment?

Which is bigger Ponzi scheme?

A comment on my recent post made me realize that I’ve been wrong about Social Security this whole time. It isn’t quite a giant Ponzi scheme, but if we’re being flexible with our definition of Ponzi scheme it may still be the biggest.

Many people are happy to pay into Social Security thinking they’ll get a reasonable return on their “investment”. To the extent that that’s true, and that return is financed by other people paying in (rather than on actual investments) it’s a Ponzi scheme. But others don’t pay in voluntarily. To the extent that that’s true, it’s like theft but with the robber systematically dropping some of the money. Quasi-Ponzi scheme might be a better term. Social Security paid out $615B in 2008. Let’s guess $650B for 2012. If that was all happy money, it’s one big Ponzi scheme.

But the U.S. government has another project that more closely resembles a Ponzi scheme: Treasury bonds. Here people voluntarily fork over money for a return that is financed in part by later “investors” buying Treasury bonds. Of a $3.5T budget with a $1T deficit, 6% went to paying interest last year (that’s $223B). So 29% of the budget was deficit, and we might conclude that approximately $65B of interest (0.29*$223B) is “Ponzi-financed”.

So now the question is how much of Social Security is “happy money”? Anything more than 10% makes it the bigger Ponzi-scheme. But even if Social Security is heavily financed with “happy money” it is still taken at gun point while purchasers of bonds are there voluntarily. If the government were looking to save $223B and only Social Security benefits and interest payments were on the table, the more ethical choice is to default (if not repudiate). As I recall, I’m ripping off this point from Jeff Hummel.

Balanced Budget Amendment Slated to be Rejected by Tomorrow

So Tomorrow’s the big day. The U.S. government is slated to hit the debt ceiling, and with it will be faced with the prospect of actually having a balanced budget. I think the situation is nicely summed up in the opening sentence to an article from Cato: “America faces two very serious budget problems: Democrats, and Republicans.” Of course behind those problems are voters who vote for their congressman to steal and object to others’ doing the same.

This root problem is interesting and I’d like to take a minute to speculate about it. It looks like long term economic growth in the U.S. will slow down. The pace of government expansion can only continue so long before growth slows to a crawl and we hit some equilibrium. What happens then? I think there will be two changes in patterns of entrepreneurship.

The first change is a general decline in growth-oriented entrepreneurship. As the returns to private investment fall, young innovative entrepreneurs will focus on improving their (non-taxable) lifestyle rather than getting rich. Better to run a cool boutique shop and spend lots of time loafing around than work your ass off to pay taxes. Even more likely, students trained in navigating public schools and subsidized colleges will find themselves more at home in bureaucracy than industry. C students will get productive jobs and A students will shuffle papers.

The second change is an exodus of entrepreneurs. The U.S. isn’t the only game in town. The ambitious few who decide they want to make it big (and whose entrepreneurial spirit hasn’t been ground down by life in a culture that isn’t any longer interested in such ambition) will go elsewhere. And places like the Cayman Islands will get freer and flourish as they attract these entrepreneurs.

The U.S. as a country will gradually fade from prominence, the world will be less free overall, but some places will do well and will perhaps foster long run shifts.

Path Dependency and the Republican Party

Let’s apply path dependency to the plight of the national Republican Party and see where it takes us:

Writing in Fortune in the run-up to the 1962 congressional elections, Max Ways asked, “Is Republicanism a Losing Cause?” Arguing at the height of JFK’s popularity that there was nothing wrong with the party’s two main convictions, namely that individual liberty is best served by a strong, yet limited, federal government, and that “market capitalism is a beneficent force in the world,” Ways insisted that Republicans would never “reinvigorate their party so long as they let the Democrats set the terms of battle.”

After a drubbing in the 1964 election, the party was able to set the terms of battle as America’s cities burned and the war in Vietnam headlined the evening news. In Ronald Reagan, the party’s reinvigoration was complete. His ability to communicate the party’s convictions and win elections suggested that Republican dominance of the White House might be sustained. It wasn’t. But even in the aftermath of defeat, in 1992, the party could take solace in Bill Clinton’s declaration that the era of Big Government was over. Perhaps the party had truly won the battle of ideas.

But now the Republican Party has come full circle, and is again in crisis, having suffered defeat in the popular vote in five of the past six presidential elections. As was the case in 1962, there is no end to prescriptions for saving the GOP. To the accumulating heap of advice, I add this to the pile: Consider path dependency before formulating policy, conducting politics, and making appeals to voters.

California’s Republican Governor Arnold Schwarzenegger famously promised to “blow up” the boxes of a bloated government in Sacramento—and then not much happened. At the national level, Republicans have been promising to repeal, dissolve, and defund laws, agencies, and programs since the 1930s, with little overall success, notwithstanding the odd victory here and there. The yearning to begin anew may be alluring, but there ain’t no going back.

In rhetoric, Republican Party leaders still call for ratcheting back Leviathan, at least on the economic front. Yet, just as Governor Schwarzenegger did, they falter when it comes to actually blowing up the boxes of government. Republicans make poor revolutionaries. At the same time, they seem to have eschewed democratic politics as a means to their ends. Perhaps, in their view, playing politics would constitute an exercise in making “socialism” more efficient, in which they allegedly hold no interest. But by failing to reconcile ideas and ideals with path dependent history, the party is becoming ever more out of touch.

Gaining an appreciation for path dependency may help the party connect with voters: a prerequisite to articulating effectively a vision of a political economy based on individual liberty, limited government, and market capitalism. After all, if no one is listening, it doesn’t really matter what you might be saying.

Another problem: It’s rather difficult to figure out what the Republican Party stands for these days. Since the 1980s, its calls for racheting back Big Government have been long on promising a return to some ideal state and short on mapping a pragmatic path toward reining in the actually existing state. Interestingly, the rhetoric heats up when the party is out of power, casting doubt on the sincerity of those spouting it. When they have occupied the Oval Office, Republicans have had no less a penchant increasing the size and scope of government than the Democrats they accuse of being enthusiasts for socialism. The Bush administration used the crisis of 9/11 to increase government surveillance of private citizens and expand Washington’s interventions overseas. The crisis of the Great Recession served as occasion to bail out Wall Street. Indeed, in economic terms, Republicanism has come full circle, not from the free soil, free labor, and free men days of Lincoln, but from the Gilded Age. Where the rubber hits the road, that is, in terms of implementation, there is little evidence that the Republican Party holds individual liberty, limited government, and market capitalism as core convictions. But let’s stipulate, for the sake of this post, that Republicanism at its core remains grounded in the two main convictions identified by Mr. Ways.

So how might a consideration of path dependency help to right the listing Republican ship?

In a previous post, I applauded Daron Acemoglu and James A. Robinson for their effective deployment of path dependency in Why Nations Fail: The Origins of Power, Prosperity, and Poverty. They showed that “critical junctures” that disrupt the existing political and economic balance in society launch nations down their respective dependent paths. And once embarked on a dependent path, the weight of history makes it extremely difficult for a nation to change course.

In America, as Robert Higgs has shown, two world wars, with a great depression sandwiched in between, constituted the critical junctures—or critical episodes, as he calls them—that resulted in an immense expansion in the scale and scope of the U.S. government. With the passage of time, the American people have accepted most aspects of Leviathan—especially when it comes to social insurance—as the norm. In Higg’s view, there is no going back because the federal government’s responses to successive crises engendered a sea shift in ideology among the people. Writing in 1987, Higgs doubted that the Reagan Revolution would live up to its billing. And he was spot on.

For an intraparty conversation on the appropriate scale and scope of government to be productive and persuasive, it ought to begin with coming to terms with the state as it “really is” and reflecting on how it came to be (including the many contributions of all postwar Republican administrations to expanding said state).

Take Social Security. Opposed on the Right, it was passed in a form that didn’t please the Left. But over the years, Social Security expanded in scope and size under Democratic and Republican administrations alike. It’s now been around for more than 75 years. Talk of entitlement reform as Baby Boomers age, at least in terms of assessing, funding, and perhaps adjusting future liabilities? Absolutely. But apocalyptic talk of Social Security’s impending bankruptcy as prelude to overhauling this mainstay of middle-class entitlements surely has lost more votes than it has gained. And to what end? Leaving aside the question of individual liberty, replacing mandated contributions to a government plan with mandated contributions to private ones introduces risk for which future retirees seemingly have no appetite. Path dependency does not mean that all doors to reform are shut for all time. But Republicans have little hope of blowing up this box.

So, what to do? First, acquire a deep appreciation for the path dependencies embedded in America’s laws, regulations, policies, and political institutions. Use the exercise to identify potentially winning issues that align with core convictions, as stipulated. Then embrace the democratic process as a platform from which to win hearts and minds and accomplish realistic goals.

The Fiscal Cliff

The “fiscal cliff” is the economic plunge that will occur in the U.S.A. if Congress does not change the big tax hikes and spending reductions that will otherwise start on January 1, 2013. The income tax rate cuts enacted at the beginning of the ozo years (2000 to 2009), as well as the payroll tax cuts that followed the Crash of 2008, were temporary and are scheduled to expire at the close of 2012.

Congress enacted the Budget Control Act of 2011 to require “sequestration” – automatic sharp spending reductions in 2013 – unless it enacted the recommendations of a “supercommittee,” which then failed to achieve a consensus on raising revenues and cutting spending.

Now in mid November 2012 the economy is a train heading towards the cliff, and if Congress does not lay down a track to make the train veer off to the side, the economic train will plunge into another depression. Continue reading

Warren Harding’s Fiscal Cliff

The economy is in rough shape right now but suppose it were even worse: unemployment at 12% rather than 8%; GDP falling at a 17% annual rate rather than rising slowly. A close advisor to the President counsels an array of interventions to stimulate the economy but is ignored. Instead, the President cuts Federal spending in half and engineers drastic reductions in income tax rates for all groups. Meanwhile the Federal Reserve, rather than cranking up the printing presses for a round of monetary stimulus, snoozes through the whole year.

Now there’s a fiscal cliff for you. If today’s thinking about the fiscal cliff of Jan. 1, 2013 held true, surely such policies would tank the economy big-time.

The foregoing scenario actually happened. The year was 1920, the President was Warren G. Harding and his  close advisor was none other than Herbert Hoover, who as President from 1929 to 1933 would have his way – raising taxes, jawboning wages, and slapping a killer tariff on the economy, thereby doing a great deal to turn the rather mild downturn of 1929-30 into the Great Depression which, with lots of help from Franklin Roosevelt, would plague the nation for another decade.

close advisor was none other than Herbert Hoover, who as President from 1929 to 1933 would have his way – raising taxes, jawboning wages, and slapping a killer tariff on the economy, thereby doing a great deal to turn the rather mild downturn of 1929-30 into the Great Depression which, with lots of help from Franklin Roosevelt, would plague the nation for another decade.

So what happened in Harding’s time? Things were pretty rough for a while but by the summer of 1921, signs of recovery were already visible. The following year, unemployment was back down to 6.7% and hit 2.4% by 1923 (source: Thomas Woods, “The Forgotten Depression of 1920″). A budget surplus arose resulting in a noticeable decline in the national debt. Business confidence soared and the 1920’s boom was off and running.

President Harding has gotten a bad rap from history because of the scandals that erupted during his administration as well as his chronic womanizing and his passion for the bottle. But in the countdown of 20th century Presidents that I might do for this blog should I ever get ambitious, I will start with Harding as the least bad President of that sad century and work my way down from there. I’ll let you guess who I will honor as the Worst President of the Century.

How does the looming fiscal cliff compare with the policies of 1920? In case you’ve been hiding under a rock lately (not a bad way to ride out the election campaign!), the fiscal cliff is the set of automatic tax increases and spending cuts that were agreed to when the debt ceiling was raised in 2011. Congress decided to force its future self to act by lighting a time bomb that it would surely – surely! – defuse before it could go off. The fuse has now burned to within 1/8 inch of the bomb.

The bomb’s tax increases and spending cuts would reduce the deficit by an estimated $600 billion in one year. That may be the most accurate estimate but it’s only an estimate. Congress can set tax rates but tax revenues depend on the size of the tax base. If highly productive people, those who would take the biggest hit, decide to Go Galt, the tax base could shrink. And as Jeff Hummel likes to point out, tax rates, particularly the top marginal rates, have varied drastically over the years and yet tax receipts have not varied much from 20% of GDP, excepting the World War II years.

Not only might tax receipts fall short, but expenditures could rise if additional welfare payments such as unemployment benefits or food stamps were to rise.

But let’s assume the fiscal cliff happens and the deficit is indeed reduced by $600 billion. Using figures for the fiscal year just ended, we would still have a $400 billion deficit which would have to be financed by borrowing. As always, this would be new borrowing, on top of the borrowing needed to roll over the daily stream of maturing debt. And we mustn’t forget the Social Security Trust Fund which until last year has mitigated the deficit by “investing” its surpluses (FICA tax revenues minus benefit payments) in Treasury securities. Those FICA surpluses have now turned to deficits which for the present are offset by interest payments on Trust Fund holdings but will eventually require the Trust Fund to stop rolling over maturing securities and, should the trend continue, to deplete its holdings entirely. All of these developments exacerbate the main federal deficit. The same applies to the much smaller Medicare Trust Fund.

So I say, with a glance over my shoulder at 1920, bring on the fiscal cliff! Let the cuts happen, thereby ending a lot of wasteful and harmful spending – particularly “defense” spending. Let tax rates rise; people will work around them.

But it won’t happen because too many special interests will rise up to prevent it:

- There are enough military personnel, military contractors, their suppliers, relatives and hangers-on to prevent significant cuts in defense spending.

- The 27% cut in Medicare physician fees will lead doctors to brush away their Medicare patients like flies, sending those patients hobbling off to howl at their their Congressmen.

- Millions of middle class people will gasp when their tax preparer tells them they’ve been caught in the dreaded Alternative Minimum Tax trap. Others will escape the trap only to find that their ordinary income tax rates have risen substantially.

- Still more millions will see their FICA (Social Security) tax rate revert to the 2010 rate of 6.2% from the current 4.2% “stimulus” figure.

The fiscal cliff won’t happen, at least not all of it, except perhaps for a brief period in January which will be fixed retroactively. And so, though I hate to say it, I think the longer-term odds of pulling out of our fiscal death spiral are pretty slim. Many think the government will resort to the time-honored remedy of the printing press, but Jeff Hummel has made a solid argument as to why this option won’t work and why there will be a default on Treasury securities instead.

Hummel also urges economists to do whatever they can to warn people not to count on government largess. Most young people have written off Social Security for their future and that’s a good thing. (Not so good for Social Security recipients like me who are increasingly unemployable yet hope to live another 25 years.) We must take responsibility for our own health care, first by watching our health habits and second by cultivating a personal relationship with a physician, perhaps offering him or her cash payments. We should be leery of Treasury Securities or of banks, mutual funds, etc. that rely heavily on these securities. Sock away a few gold and silver coins.

We’re in for a rough ride, I fear, over the next few years. But the sun will still rise and tangible assets will remain. Provided enough of us have taken precautions, social unrest will be manageable and maybe, just maybe, the cancer that is called Social Democracy will be shaken off once and for all.

Fwd: Warren Buffet’s Idea for Passing the Budget

Dr. Delacroix recently e-mailed me the following chain. I thought I’d reproduce it here since most of my e-mail contacts are from school and I use it get laid rather than to argue about politics. I don’t agree with everything Buffet says, of course, but when somebody says something smart or thoughtful, I’ll take it into consideration no matter which quadrant of the political section it comes from. The chain is below the fold. Continue reading