A ‘sociology’ paper by LA Repucci

Wealth vs Wages

Much hay is made of the distribution of wealth in the modern United States. Recently, the Occupy movement has protested the accruing affluence of a shrinking number of individuals that constitute the top ‘1%’ of wealthy within the country. Data suggests that the top 1% of income earners in the country represent a myriad of professions, investments, and financial instruments as revenue streams, with the largest portion (30.9%) represented as the executive/corporate professionals, as shown by graphic 1.1 below:

1.1: Top 1% of Wage Earners by Profession, US. Source, Wikicommons

Analyzing the data from this table paints a picture of broad distribution of wage incomes across a myriad of industries, but fails to account for the disproportionately massive amounts of wealth that aren’t generated by salaries at all, nor are they representative of the fact that the wealthiest legal entities within the US aren’t people — they are tax-sheltered corporate entities:

1.2: Corporate Profits vs Tax Liability

The Corporate Model

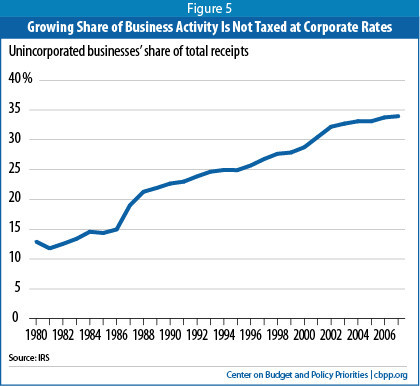

Corporations are paper entities recognized by the state as legal persons. They exist in order to generate and accrue revenue, and pay stakeholders. Unlike natural persons, corporate entities are immortal. Instead of competing on the open marketplace for revenue, the most successful and largest corporations have discovered a way to cut the market out of their revenue streams altogether. It is simply easier and more cost effective to lobby the state to enact laws that protect their revenue stream and squash market forces than it is to operate within a competitive market. Progressive, draconian tax structures enacted as a hedge against corporate domination of wealth may be adopted by government in an effort to increase tax revenue from the corporations, but in reality, simply provide further incentive for corporations to allocate resources in an effort to mitigate or outright eliminate their tax liability within the US. For example, Google, the fastest growing and wealthiest of the new tech giants, pays a majority of it’s taxes in Ireland and Bermuda — nations with a far friendlier income tax policy than the US — and bypass their US tax liability almost entirely due to the so-called ‘loophole’ in the income tax law, resulting in the federal government’s lost tax revenue from one of the largest US corporations in history. This leads increasingly to a larger percentage of individuals, sole proprietors and small-to-mid cap businesses shouldering an increasing burden within the tax structure as shown in 1.3 below.

1.3

The State’s Culpability

The new corporate model of tax evasion coupled with astronomical growth in profits-to-cost relies heavily on the government’s complicit action with regard to tax policy and recognition of corporate person-hood. It is in a company’s interest to make money — but to ‘saw the ladder off’ below them, they require government cooperation to enact laws that make tax sheltering and corporate personhood possible. This culture of lobbying and outright appropriation of the legislative process has progressed to the point that there is little differentiation between the state and the corporation. Insurance companies write health care laws, and banking institutions write tax laws and set monetary policy. The roots of this collaboration run deep through US history, crystallized notably by the creation of the Federal Reserve Bank in 1913 on Jekyll Island by J.P. Morgan, Paul Warburg and other global-level financiers with the collusion of Senator Nelson Aldrich, who had close ties to both Morgan and Nelson Rockefeller. (Further reading: ‘The Creature from Jekyll Island’ by E.B. White) The Federal Reserve Act of 1913 was signed into law by then US President Woodrow Wilson, and effectively turned over control of the nation’s monetary policy, issuance of currency, and anti-market fixing of interest rates to a private bank set up as a for-profit corporation called the Federal Reserve Bank, effectively undoing the American Revolution and the work of his predecessor, President Andrew ‘Old Hickory’ Jackson. The ‘Fed’ as it is known today, continues to be the sole issuer of paper money accepted for the payment of taxes in the US. While the people remain ‘free’ to trade in whatever currency or barter they choose, all state and federal taxes in the US must be paid in Federal Reserve Notes, giving the Fed a monopoly on currency.

The Corporate-State Combine

A century of the above-outlined activities of corporate entities have led to an overlap between the banking community and government that often goes understated. JP Morgan/Chase market their banking services directly to government, as clearly outlined in their marketing materials: https://www.jpmorgan.com/pages/jpmorgan/cb/government. It is no surprise that most of the nominees for president, cabinet members, the Fed and legislators exist in a professional ‘revolving door’ environment that moves them from banking to high office and back over the course of their careers. For example, both major party candidates for president in the last 20 years have had direct professional ties to JP Morgan and Goldman Sachs. This ‘partnership’ has led to a century of collusion between government and banking, taking an ever-increasing cut of the total wealth out of the real market, and enriching our legislators to the point that many of the wealthiest counties in the nation now surround Washington DC as evidenced in the data provided. This corporate-government combine acts as a siphon, sucking wealth out of the population through inflation, currency devaluation and increased tax burden, and enriches the corporate interest through outright gifting (TARP, Stimulus, Bailouts, etc) to the wealthiest of the wealthiest of the 1%. Warren Buffett, one of the wealthiest men in the world and owner of Berkshire Hathaway Ltd. championed bailouts while his firm received the largest portion of us taxpayer money from the TARP program. Buffett himself pounds the table for higher tax rates, while he and his company manage to ‘limit’ their tax liability and avoid paying taxes owed back to 2002. Mr. Buffett is a major campaign contributor to our current President, Barack Obama.

Solutions

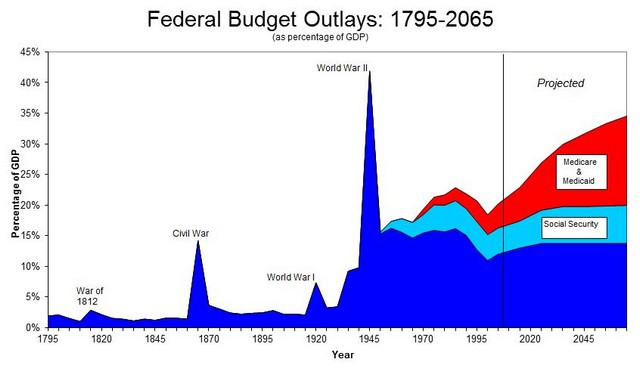

With the compound factors of massive increases in government spending (roughly $20,000 annually per citizen), and the steady evaporation of corporate tax liability (less than 40% of the total tax base of businesses in the US is covered by large-cap corporations) the problem of the distribution of wealth in the US is starkly apparent. To identify what is going wrong in the economy is one thing — providing real solutions is another entirely. Both major political parties offer their version of the fix — the right would suggest cutting government spending on services and lowering the tax base to broaden it and encourage large cap corporate interests to pay their income taxes in-country. The left advises steeply progressive tax laws on private citizens (one would assume the left would suggest tax reform for large corporations, but the democrat party has been in charge of the tax law for decades with no such legislation to speak of), and consumption and indulgence taxes on goods and services, combined with further devaluation of the dollar through Quantitative Easing (QE) and raising (or outright elimination of) the debt ceiling.

While it would seem that these two paths are the only potential ‘fixes’ to our nation’s distribution of wealth problem, neither of these plans would provide real, permanent relief to the average citizen who is continually squeezed out of the middle of the economy, with an ever-increasing portion of their revenue taken by the state through tax, and devalued by the state through inflation. Indeed, it would seem that our problem is not ‘distribution of wealth’, but rather, the redistribution of wealth through taxation and devaluation of the dollar. Looking at the problem from this perspective, the solutions become simpler and multi-fold.

Monetary Policy/END THE FED

Should the Federal government enact law that checks the monopoly power of the Fed to issue currency by accepting in payment of taxes any and all used currencies in the market, the nation would be free to adopt currencies other than the dollar.

Bitcoin, a decentralized crypto-currency, is a notable example of a market solution to the problem of distribution of wealth. Though Bitcoin has it’s detractors and a relatively small market cap, it’s value has continued to skyrocket on the open market, and is in the early stages of large-scale adoption and public use. Bitcoin requires no bank or government to ‘mint’ it as a currency, and is freely traded electronically between users with no bank needed.

Similarly, gold and silver have been used for thousands of years the world over as viable hard currencies. Hard currencies cannot be devalued through running of a printing press like paper currencies, nor through the click of a button like crypto-currencies. As there is a finite amount of gold and silver in the market, it’s value has a ‘hard floor’ — it is always worth at least it’s value as a raw material.

The fact that the Federal government will only accept Federal Reserve Notes (which, in itself violates the constitutional directive for the US Treasury to mint coin, not a private bank) in payment of taxes effectively gives the FED a monopoly on currency. The last US President to order the Treasury mint silver certificates was John F. Kennedy.

Commercial Policy/END CORPORATE PERSON-HOOD

Corporations are legal ‘persons’ with the ability to lobby the legislature directly, resulting in tax laws and policies that favor them over natural citizens of the US. This has resulted in laws being written directly by corporations, including insurance companies’ authorship of the Affordable Healthcare Act. The insurance companies’ stock has risen by a factor of 2-5 due to the implementation of the law, while the cost of health insurance for the average citizen has skyrocketed. Ending corporate person-hood would go a long way to ending the power of lobbyists to purchase legislators, and result in elected officials representing the people who elect them.

Tax Policy/END THE TAX

‘Taxes’, ‘tariffs’, or any other name the state wishes to apply, are simply pseudonyms for extortion — that is, the violation of individual property rights through threats of aggressive reprisal. When private entities such as a thief or mob perform the same action, we rightly call it theft. It is completely inconsequent what a thief does with your money once he has violated your rights to acquire it, even if he assures you that it is to your personal, direct benefit that he take your property from you by force. To fix the distribution of wealth, and as well to return to a moral society where one does not live on the property of his neighbor through state-sponsored theft, all taxes should be eliminated. If a portion of the population would like to provide a service or product to their neighbors, let them do so legitimately through voluntary free association and exchange. The state spends more than it takes in in taxes, and floats the rest on credit. This activity has crippled the purchasing power of the dollar, which has lost 99% of its total purchasing power on the market in the 100 years the Fed has controlled the nation’s currency.

Bibliography:

Wikimedia Commons. N.p., n.d. Web. 04 Dec. 2013.

JP Morgan.com “State and Local Government.” N.p., n.d. Web. 06 Dec. 2013.

Cogan, John F. Federal Budget Deficits: What’s Wrong with the Congressional Budget Process. Stanford, CA: Hoover Institution, Stanford University, 1992. Print.