A good op-ed in the March 24 issue of the Wall Street Journal by Mark Krikorian forces me to go back to one of my recent postings on immigration: “Immigration and Jobs.”

Krikorian is executive director of the Center for Immigration Studies in Washington D.C. Mr Krikorian accuses everyone in America of “not facing the facts” about current and recent immigration. He insists that some questions must be posed instead of skirted. I agree, of course, but I don’t know that it’s true that people are not facing the facts. I think instead that many busy and fair people are hearing contradictory statements and that they don’t have a good framework to think things through. Krikorian states that he rests his case on an authoritative study by the National Academies of Science, Engineering and Medicine. The academies are a respected source. I take it seriously if Krikorian reports accurately. (Be aware that I have not read the study in question.)

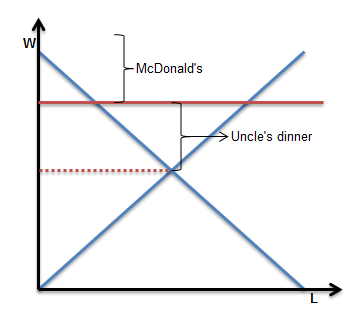

Krikorian’s most troubling assertion is as follows: All Americans benefit from immigrants being in the US. This benefit is entirely extracted from the higher wages Americans competing with immigrants would receive absent wage lowering immigrants’ competition. In other words: Americans who compete with immigrants receive lower wages than they should; everyone else benefits from these lower wages.

I think that’s obviously overstating the case. There must be at least one immigrant generating product (GDP) that would not otherwise exist in the American economy. Maybe, there are two. One is in Silicon Valley, inventing a product – like the personal computer forty years ago – that will eventually cause the employment of thousands, or millions. The second is in Kansas, saving from demolition a beat-down hotel that provides immediate employment for two-to–four minimum wage-earning maids. (Both entrepreneurs are Indians, obviously). In general, immigrants might benefit all by offering additional, or better, services than do the native born. I develop this thesis below.

Krikorian seems to be operating from a standpoint where the work pie to be shared by Americans and by immigrants is of a permanently fixed size. This erroneous perspective, in turn, may well come from a respectable desire to stick close to research findings. Research that also (also) takes into account immigrants’ contribution to increasing the size of the pie is doable but it’s more difficult to perform and to integrate with previous findings than research that relies on a static representation of reality.

Let me admit that I don’t have any numbers at my disposal and that any reasonably credible set of numbers could blow out of the water everything I am going to say below.

First, it’s obvious that there are currently many unfilled jobs in the US. Organized labor and anti-immigration spokespeople will argue that all those jobs would be filled if the wages offered were high enough. I am skeptical of this argument for two reasons. First, Silicon Valley employers affirm vigorously that they just don’t find enough would-be employees with the required skills, at any price. I tend to believe them to some extent because they evidently spend energy and resources raiding each other for expensive existing personnel. This kind of practice suggests true, absolute scarcity. I have mentioned in one of the companion essays the difficulty farmers encounter in recruiting pickers even when they offer wages significantly superior to both the minimum wage and to the going wage in my job-poor area. I would argue that their difficulties are rooted in the same problem facing Silicon Valley employers: a shortage of local competence. Picking strawberries, for example, is not easy at all. And it requires a certain attitude, or fortitude, that is not common anymore among Americans, as I have argued elsewhere.

Second, presented below, a forbidden argument. But I must make a disclosure before I move to it: I am one of the 43 million foreign-born people now living in the US. I studied in the US and I was permanently admitted on a variant of a B1 visa. I had a main career as a university professor. I don’t believe that an extra teaching position was ever added in any university to accommodate me. (It happens for some foreigners, a very few, of star quality, like Einstein; I wasn’t one of them, let’s face it.) Of course, to obtain any university position, I had to possess the same credentials as native-born Americans who also wanted the position. (That’s right, there is no affirmative action track for white Europeans!) Good university positions are surprisingly competitive to obtain; earning tenure is even more competitive. Every position I obtained, I got from winning against similarly situated native-born.

Each time, I won the gold, if you will. This simple fact would seem to suggest that I was at least slightly better in conventional terms than those native-born who did not get the position. This fact implies at minimum that had I not competed for the position my students would have been served at best by a silver medalist. (I choose the Olympics language on purpose, from a surfeit of honesty. It’s not absurd to argue that the quality difference between the gold and the silver winners is insignificant or even accidental: On a different day, with a different wind, perhaps, the silver winner would have won the gold. But there is more.)

Like many but not all immigrants, I grew up in a language different from English, French in my case. So. I had to achieve the same credentials as my competitors in what was for me a second language. Forgive me for seeming to brag but doesn’t this indicate an intellectual competence over and above what the formal credentials express? If you doubt this shameless assertion, ask yourself how many native-born Americans are able to teach anything – besides the English language – in any francophone university anywhere. And I am not an extreme case of talent among immigrants to the US. I know a man, a distinguished biological scientist, who grew up in the African language Wolof, went to secondary school in French, to college and graduate school in English. Would you guess he possesses a certain mental nimbleness uncommon among determined monolinguals?

I will reluctantly take another step. I do it reluctantly because it is sure to lose me some friends. I will use my own case as an immigrant for an example because it’s the case I know best. It’s about the cultural endowment we carry around over and above, or aside from mastery of a foreign language.

Let me say right away that I don’t contend that I enjoy a 100% understanding of American culture, even after fifty years. I don’t understand the rules of baseball, for example. I never bothered to learn because the game seems boring. Yet, I must be conversant with a lot of national culture, just for having acquired my professional credentials and, even more so, for navigating everyday life in my society of adoption. The point is that the acquisition of another culture does not entail a one-for-one exchange, like changing clothes, for example. Much, most of what the immigrant brings with him, he retains, as one might easily assume. When I was learning American culture, I was not leaving French culture behind with the hat-check girl.

The first thing that immigrants, those who immigrate as adults, keep is mastery of their native language. This may sound mysterious to a monolingual person. It’s true that one can become “rusty” in a language one does not use. The quality of self-expression, for example, may deteriorate over time spent abroad. Yet, it’s very unlikely that an immigrant will lose the ability to watch the news in his native language, or to read a newspaper. So, I follow the news in English, of course, but also in French, some of the time. The reporting of the same events do not overlap perfectly, far from it. So, I am learning things I probably would not learn if I knew no French. (That’s in addition to carrying in my head much disorderly information from my society of origin. More below.) In my job as a teacher and as a scholar, I was routinely able to draw on broader information than did my native-born colleagues. I wouldn’t say (although I am tempted) that I had twice as large a store of information at my fingertips as they did but that I had definitely more than they.

So, in fact, I am arguing – with little embarrassment – that I must have been a better teacher and scholar than most (not all) of my native-born colleagues with similar credentials by virtue of being an immigrant.* There may be no metrics allowing an assessment of this outrageous claim. That’s because what college professors actually do is so mysterious. (Another story.)

It’s also true that to measure accurately the added work value of immigrants you have to find a way to factor in laziness, which varies much among individuals. In my case, I suspect strongly that if I had been native born, I could not have had the normal academic career I enjoyed, given my above-average level of laziness. In other words, the informational advantage associated with being a bilingual immigrant may have paid the fare for my laziness. Had I been the same person, with the same formal credentials, except less lazy, however, my presence would have much benefited American society. This detour supports my main argument of course: It does not make much sense to deny that competent bilingualism adds to normally credentialed efficacy. This is true in an occupation such as university teaching. It’s true though possibly to a lesser extent, for a plumber who will, at least, be a better citizen than a comparably situated monolingual. This is all common sense. No hard data are needed to give this scenario credence although hard figures might destroy it.

It should be fairly clear that a second language is like another tool in one’s personal toolbox. Immigrants have yet more, other additional tools that may be more elusive, more difficult to describe. I am giving it a try. All of us approach new situations through a filter that is made up partly of our past experiences, through the colander of past experiences if you will. Many of the experiences that compose the sifting device are repetitive, partly superfluous: The tenth car accident you witness does not have the same power to influence your driving as the first. There is often an excess of material in the sifter. This means that whatever the sifting process accomplishes would be accomplished as well, or nearly as well, on the basis of fewer past experiences.

My experiences in my society of origin do not perfectly duplicate those of a similarly situated native-born American. For example, I lived through a school system that was much more authoritarian than he experienced. I take from this the strong impression that my experiences in my society of origin adds to my experiences in my society of choice to give me a better sifter than what exists among the native-born population. It does this in a non-repetitive way (unlike, say, the 9th car accident.) I don’t mean that I have twice as large a sifter as they do but perhaps that I have 125% of what they carry in their heads.

This second extra tool in my tool box is factually associated with the first, bilingualism, but it’s not the same thing. An Australian, with a perfect command of English and perfectly innocent of knowledge of another language would carry the same extra tool as I do. The advantage gained through this second tool is difficult to express. It’s tacit. (I have never read anything about the topic.) I believe that my experience of another society – again, independently of bilingualism – acts like a second pair of glasses. I think I am able to watch events and people from one perspective, and then, to some extent, from a second perspective. I suspect it does not give me extra-depth but an edge in exercising common criticality. Possibly, it acts like a few IQ points that would be added to my measured IQ. Again, this thesis is very exploratory, supported by no real numbers. I must add that this second tool associated with being an immigrant is free from the effects of education. I think I have observed the expected extra resourcefulness among Mexican immigrants I knew to be semi-literate (in Spanish) performing ordinary manual jobs, in construction and in repair work, for example.

In conclusion: I and hundreds of other immigrants I have observed contribute to the society in which we live over and above the contributions of the native-born. Thus, we add to the general well-being even if we are paid exactly the same as the native-born.

The above is a short string of arguments in favor of immigration. None of it is a call for open borders. I subscribe to the lifeboat view of immigration. Too numerous immigrants could easily sink the boat that made them swim to developed societies in the first place. (According to retired foreign service officer Dave Seminara’s review of relevant studies – that I have not read – 150 million people world wide would like to move to the US, including 34% of Mexicans.) In addition, there are non-economic arguments against large-scale immigration that I support although they may be even more difficult to describe than what I tried to explain above. My analysis supports instead an active stance to design immigration policies that make rigorously the conceptual distinction between immigrants we need and immigrants in need. This distinction is not inimical to any refugee policy whatsoever; perhaps, the reverse is true.

* Please, don’t try to factor in a putative superior European education brought to the job of being an American academic as an alternative explanation. I am a French high school dropout.