It’s been a heck of a year. Thanks for plugging along with Notes On Liberty. Like the world around me, NOL keeps getting better and better. Traffic in 2019 came from all over the place, but the usual suspects didn’t disappoint: the United States, United Kingdom, Canada, India, and Australia (in that order) supplied the most readers, again.

As far as most popular posts, I’ll list the top 10 below, but such a list doesn’t do justice to NOL and the Notewriters’ contribution to the Great Conversation, nor will the list reflect the fact that some of NOL‘s classic pieces from years ago were also popular again.

Nick’s “One weird old tax could slash wealth inequality (NIMBYs, don’t click!)” was in the top ten for most of this year, and his posts on John Rawls, The Joker film, Dominic Cummings, and the UK’s pornographer & puritan coalition are all worth reading again (and again). The Financial Times, RealClearPolicy, 3 Quarks Daily, and RealClearWorld all featured Nick’s stuff throughout 2019.

Joakim had a banner year at NOL, and four of his posts made the top 10. He got love from the left, right, and everything in between this year. “Elite Anxiety: Paul Collier’s ‘Future of Capitalism’” (#9), “In Defense of Not Having a Clue” (#8), and “You’re Not Worth My Time” (#7) all caused havoc on the internet and in coffee shops around the world. Joakim’s piece on Mr Darcy from Pride and Prejudice (#2) broke – no shattered – NOL‘s records. Aside from shattering NOL‘s records, Joakim also had excellent stuff on financial history, Richard Davies, and Nassim Taleb. He is also beginning to bud as a cultural commentator, too, as you can probably tell from his sporadic notes on opinions. Joakim wants a more rational, more internationalist, and more skeptical world to live in. He’s doing everything he can to make that happen. And don’t forget this one: “Economists, Economic History, and Theory.”

Tridivesh had an excellent third year at NOL. His most popular piece was “Italy and the Belt and Road Initiative,” and most of his other notes have been featured on RealClearWorld‘s front page. Tridivesh has also been working with me behind the scenes to unveil a new feature at NOL in 2020, and I couldn’t be more humbled about working with him.

Bill had a slower year here at NOL, as he’s been working in the real world, but he still managed to put out some bangers. “Epistemological anarchism to anarchism” kicked off a Feyerabendian buzz at NOL, and he put together well-argued pieces on psychedelics, abortion, and the alt-right. His short 2017 note on left-libertarianism has quietly become a NOL classic.

Mary had a phenomenal year at NOL, which was capped off with some love from RealClearPolicy for her “Contempt for Capitalism” piece. She kicked off the year with a sharp piece on semiotics in national dialogue, before then producing a four-part essay on bourgeois culture. Mary also savaged privileged hypocrisy and took a cultural tour through the early 20th century. Oh, and she did all this while doing doctoral work at Oxford. I can’t wait to see what she comes up with in 2020.

Aris’ debut year at NOL was phenomenal. Reread “Rawls, Antigone and the tragic irony of norms” and you’ll know what I’m talking about. I am looking forward to Dr Trantidis’ first full year at NOL in 2020.

Rick continues to be my favorite blogger. His pieces on pollution taxes (here and here) stirred up the libertarian faithful, and he is at his Niskanenian best on bullshit jobs and property rights. His notes on Paul Feyerabend, which I hope he’ll continue throughout 2020, were the centerpiece of NOL‘s spontaneity this year.

Vincent only had two posts at NOL in 2019, but boy were they good: “Interwar US inequality data are deeply flawed” and “Not all GDP measurement errors are greater than zero!” Dr Geloso focused most of his time on publishing academic work.

Alexander instituted the “Sunday Poetry” series at NOL this year and I couldn’t be happier about it. I look forward to reading NOL every day, but especially on Sundays now thanks to his new series. Alex also put out the popular essay “Libertarianism and Neoliberalism – A difference that matters?” (#10), which I suspect will one day grow to be a classic. That wasn’t all. Alex was the author of a number of my personal faves at NOL this year, including pieces about the Austro-Hungarian Empire, constructivism in international relations (part 1 and part 2), and some of the more difficult challenges facing diplomacy today.

Edwin ground out a number of posts in 2019 and, true to character, they challenged orthodoxy and widely-held (by libertarians) opinions. He said “no” to military intervention in Venezuela, though not for the reasons you may think, and that free immigration cannot be classified as a right under classical liberalism. He also poured cold water on Hong Kong’s protests and recommended some good reads on various topics (namely, Robert Nozick and The Troubles). Edwin has several essays on liberalism at NOL that are now bona fide classics.

Federico produced a number of longform essays this year, including “Institutions, Machines, and Complex Orders” and “Three Lessons on Institutions and Incentives” (the latter went on to be featured in the Financial Times and led to at least one formal talk on the subject in Buenos Aires). He also contributed to NOL‘s longstanding position as a bulwark against libertarian dogma with “There is no such thing as a sunk cost fallacy.”

Jacques had a number of hits this year, including “Poverty Under Democratic Socialism” and “Mass shootings in perspective.” His notes on the problems with higher education, aka the university system, also garnered plenty of eyeballs.

Michelangelo, Lode, Zak, and Shree were all working on their PhDs this year, so we didn’t hear from them much, if at all. Hopefully, 2020 will give them a bit more freedom to expand their thoughts. Lucas was not able to contribute anything this year either, but I am confident that 2020 will be the year he reenters the public fray.

Mark spent the year promoting his new book (co-authored by Noel Johnson) Persecution & Toleration. Out of this work arose one of the more popular posts at NOL earlier in the year: “The Institutional Foundations of Antisemitism.” Hopefully Mark will have a little less on his plate in 2020, so he can hang out at NOL more often.

Derrill’s “Romance Econometrics” generated buzz in the left-wing econ blogosphere, and his “Watson my mind today” series began to take flight in 2019. Dr Watson is a true teacher, and I am hoping 2020 is the year he can start dedicating more time to the NOL project, first with his “Watson my mind today” series and second with more insights into thinking like an economist.

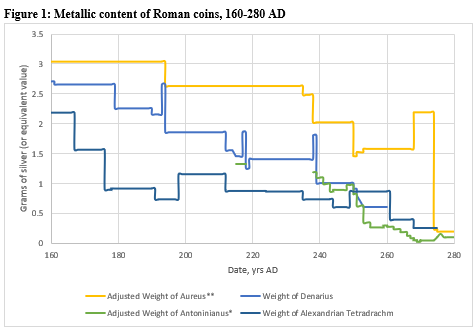

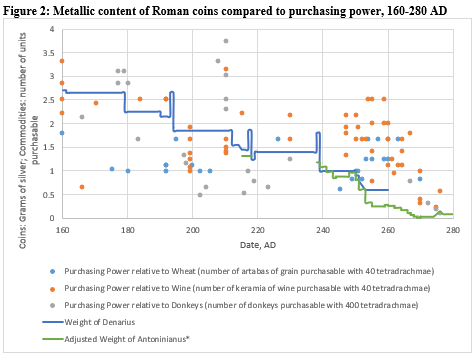

Kevin’s “Hyperinflation and trust in ancient Rome” (#6) took the internet by storm, and his 2017 posts on paradoxical geniuses and the deleted slavery clause in the US constitution both received renewed and much deserved interest. But it was his “The Myth of the Nazi War Machine” (#1) that catapulted NOL into its best year yet. I have no idea what Kevin will write about in 2020, but I do know that it’ll be great stuff.

Bruno, one of NOL’s most consistent bloggers and one of its two representatives from Brazil, did not disappoint. His “Liberalism in International Relations” did exceptionally well, as did his post on the differences between conservatives, liberals, and libertarians. Bruno also pitched in on Brazilian politics and Christianity as a global and political phenomenon. His postmodernism posts from years past continue to do well.

Andrei, after several years of gentle prodding, finally got on the board at NOL and his thoughts on Foucault and his libertarian temptation late in life (#5) did much better than predicted. I am hoping to get him more involved in 2020. You can do your part by engaging him in the ‘comments’ threads.

Chhay Lin kept us all abreast of the situation in Hong Kong this year. Ash honed in on housing economics, Barry chimed in on EU elections, and Adrián teased us all in January with his “Selective Moral Argumentation.” Hopefully these four can find a way to fire on all cylinders at NOL in 2020, because they have a lot of cool stuff on their minds (including, but not limited to, bitcoin, language, elections in dictatorships, literature, and YIMBYism).

Ethan crushed it this year, with most of his posts ending up on the front page of RealClearPolicy. More importantly, though, was his commitment to the Tocquevillian idea that lawyers are responsible for education in democratic societies. For that, I am grateful, and I hope he can continue the pace he set during the first half of the year. His most popular piece, by the way, was “Spaghetti Monsters and Free Exercise.” Read it again!

I had a good year here, too. My pieces on federation (#3) and American literature (#4) did waaaaaay better than expected, and my nightcaps continue to pick up readers and push the conversation. I launched the “Be Our Guest” feature here at NOL, too, and it has been a mild success.

Thank you, readers, for a great 2019 and I hope you stick around for what’s in store during 2020. It might be good, it might be bad, and it might be ugly, but isn’t that what spontaneous thoughts on a humble creed are all about? Keep leaving comments, too. The conversation can’t move (forward or backward) without your voice.