- The Taliban of San Francisco Serge Halimi, Le Monde Diplomatique

- Citizens of the State Maeve Glass, University of Chicago Law Review

- A wake-up call the woke won’t read J Oliver Conroy, Guardian

- The man behind national conservatism Daniel Luban, New Republic

Link: The Most Controversial Tree in the World

https://psmag.com/ideas/most-controversial-tree-in-the-world-gmo-genetic-engineering

Tending an ecosystem is hard. With all the interconnections it’s impossible to do just one thing. We should absolutely be skeptical of calls to engineer the environment from the top down, but we should also recognize that we’ve already been unintentionally doing so.

To me, the linked article raises interesting questions about the sort of common law restrictions on GMO that seem reasonable. Default infertility seems like an efficient Coasian compromise for industrial GMO. But the case of the American chestnut seems like an exciting opportunity to reverse an ecological tragedy.

This case seems like a good polar opposite to Jurassic Park on the spectrum of GMO threat/promise.

Nightcap

- The missing backlash against finance Chris Dillow, Stumbling & Mumbling

- A contrarian take on the Trump tariffs Scott Sumner, MoneyIllusion

- Brave Nuclear World Emma Ashford, InkStick

- A classic in Persian literature is relevant again Joobin Bekhrad, Los Angeles Review of Books

Nightcap

- Antisemitism was anti-capitalist and anti-communist Colin Schindler, History Today

- The invention of money John Lanchester, New Yorker

- Why do we look to Science as a guide for living? Ronald Dworkin, Law & Liberty

- Salman Rushdie’s hyperloquacity Matt Hill, Literary Review

Nightcap

- Victorian values, libertarian legacy David Loner, JHIBlog

- Tyler Cowen interviews Kwame Anthony Appiah

- How I met Paul Samuelson and Milton Friedman Branko Milanovic, globalinequality

- The Christian origins of religious liberty Francis Oakley, Commonweal

Nightcap

- Against revenge porn Belle Waring, Crooked Timber

- Americans’ declining mobility Charles McElwee, City Journal

- A global age of amnesia Joel Kotkin, Quillette

- The land question in China Salvatore Babones, Asian Review of Books

One weird old tax could slash wealth inequality (NIMBYs, don’t click!)

What dominates the millennial economic experience? Impossibly high house prices in areas where jobs are available. I agree with the Yes In My Back Yard (YIMBY) movement that locally popular, long-term harmful restrictions on new buildings are the key cause of this crisis. So I enjoyed learning some nuances of the issue from a new Governance Podcast with Samuel DeCanio interviewing John Myers of London YIMBY and YIMBY Alliance.

Myers highlights the close link between housing shortages and income and wealth inequality. He describes the way that constraints on building in places like London and the South East of England have an immediate effect of driving rents and house prices up beyond what people relying on ordinary wages can afford. In addition, this has various knock-on effects in the labour market. Scarcity of housing in London drives up wages in areas of high worker demand in order to tempt people to travel in despite long commutes, while causing an excess of workers to bid wages down in deprived areas.

One of the aims of planning restrictions in the UK is to ‘rebalance’ the economy in favour of cities outside of London but the perverse result is to make the economic paths of different regions and generations diverge much more than they would do otherwise. Myers cites a compelling study by Matt Rognlie that argues that most increased wealth famously identified by Thomas Piketty is likely due to planning restrictions and not a more abstract law of capitalism.

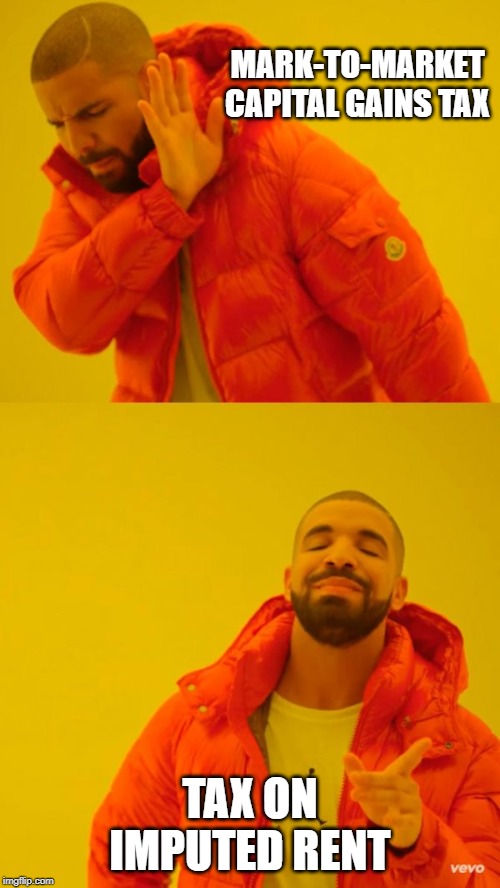

Rognlie also inspires my friendly critique of Thomas Piketty and some philosophers agitating in his wake just published online in Critical Review of International Social and Political Philosophy: ‘The mirage of mark-to-market: distributive justice and alternatives to capital taxation’.

My co-author Charles Delmotte and I argue that for both practical and conceptual reasons, radical attempts to uproot capitalism by having governments take an annual bite out of everyone’s capital holdings are apt to fail because, among other reasons, the rich tend to be much better than everyone else at contesting tax assessments. Importantly, such an approach is not effectively targeting underlying causes of wealth inequality, as well as the lived inequalities of capability that housing restrictions generate. The more common metric of realized income is a fairer and more feasible measure of tax liabilities.

Instead, we propose that authorities should focus on taxing income based on generally applicable rules. Borrowing an idea from Philip Booth, we propose authorities start including imputed rent in their calculations of income tax liabilities. We explain as follows:

A better understanding of the realization approach can also facilitate the broadening of the tax base. One frequently overlooked form of realization is the imputed rent that homeowners derive from living in their own house. While no exchange takes place here, the homeowner realizes a stream of benefits that renters would have to pay for. Such rent differs from mark-to-market conceptions by conceptualizing only the service that a durable good yields to an individual who is both the owner of the asset and its consumer or user in a given year. It is backward-looking: it measures the value that someone derives from the choice to use a property for themselves rather than rent or lease it over a specific time-horizon. It applies only to the final consumer of the asset who happens also to be the owner.

Although calculating imputed rent is not without some difficulties, it has the advantage of not pretending to estimate the whole value of the asset indefinitely into the future. While not identical and fungible, as with bonds and shares, there are often enough real comparable contracts to rent or lease similar property in a given area so as to credibly estimate what the cost would have been to the homeowner if required to rent it on the open market. The key advantage of treating imputed rent as part of annual income is that, unlike other property taxes, it can be more easily included as income tax liabilities. This means that the usual progressivity of income taxes can be applied to the realized benefit that people generally draw from their single largest capital asset. For example, owners of a single-family home but on an otherwise low income will pay a small sum at a small marginal rate (or in some cases may be exempted entirely under ordinary tax allowances). By contrast, high earners, living in large or luxury properties that they also own, will pay a proportionately higher sum at a higher marginal rate on their imputed rent as it is added to their labor income. Compared to other taxes on real estate, imputed rent is more systematically progressive and has significant support among economists especially in the United Kingdom (where imputed rent used to be part of the income tax framework).

This approach to tax reform is particularly apt because a range of international evidence suggests that the majority of contemporary observed increases in wealth inequality in developed economies, at least between the upper middle class and the new precariat, can be explained by changes in real estate asset values. Under this proposal, homeowners will feel the cost of rent rises in a way that to some extent parallels actual renters.

For social democrats, what I hope will be immediately attractive about this proposal is that it directly takes aim at a major source of the new wealth inequality in a way that is more feasible than chasing mirages of capital around the world’s financial system. For me, however, the broader hope is the dynamic effects. It will align homeowners’ natural desire to reduce their tax liability with YIMBY policies that lower local rents (as that it is what part of their income tax will be assessed against). If a tax on imputed rent were combined with more effective fiscal federalism, then homeowners could become keener to bring newcomers into their communities because they will share in financing public services.

“Crisis in the Public Square: A Kuyperian Response”

That’s the title of Lucas‘ 2018 Calahan Lecture, which he presented after receiving the 2018 Novak Award. You can catch the entire lecture here, on YouTube.

Nightcap

- The Reciprocal Transit (aliens might be watching us) Caleb Scharf, Life, Unbounded

- No government, no problem Leonid Bershidsky, Bloomberg

- Syria and Arabia: The great divide Robert Carver, History Today

- The French Left catches up to our own Jacques Delacroix Andrew Hussey, New Statesman

Nightcap

- The conservative revolutionary and the archaic progressive Arnold Kling, Medium

- Epistemological anarchism to anarchism Bill Rein, NOL

- Against adaptation Chris Dillow, Stumbling & Mumbling

- Evolutionary drift Federico Sosa Valle, NOL

Nightcap

- Europe’s Ancien Régime returns Jäger and David Adler, London Review of Books

- Monetary imperialism in French West Africa Ndongo Samba Sylla, Africa is a Country

- In defense of George W Bush Feaver & Inboden, War on the Rocks

- Justice Ginsburg on Justices Gorsuch and Kavanaugh Jonathan Adler, Volokh Conspiracy

Nightcap

- What it’s like to be black in Europe Christopher Kissane, Financial Times

- America’s other rebellious border Maxime Dagenais, Age of Revolutions

- Capitalism in America: Up, up, and away Deirdre McCloskey, Claremont Review of Books

- How Italy made me think about America Addison Del Mastro, American Conservative

From the Comments: Dual loyalties and American hypocrisy

I am on the road. I’m in Utah, actually, for a wedding. I drove here with my little family. From Texas. It’s a beautiful drive. But long. I’ll have more American pop-sociology soon enough. In the mean time, here’s Irfan on an important topic, and one that’s gone almost cold in libertarian circles:

Thanks for mentioning this post of mine. I hope people will take a look at the comments as well as the post itself. One hears so much loose talk about “anti-Semitism,” and the insult implied by talk of “dual loyalties.” But it’s not a criminal offense in the United States to believe or assert that Muslims celebrated the 9/11 attacks, or imply that Muslims side with Al Qaeda or ISIS. The President encourages people to believe and say such things, and they do, from the federal executive down to the local level.

https://thehill.com/blogs/blog-briefing-room/news/454555-new-jersey-school-board-member-says-his-life-will-be-complete

Meanwhile, the State of New Jersey is seeking to make it a criminal offense to assert that Palestinians have a right of self-defense against attackers who happen to be Jewish: $250 fine, six months in the county lock up. In this universe, either there is no such thing as a Jew who aggresses against a non-Jew, or if it happens, non-Jews are not to resist in such a way as to “harm” their attackers.

As for “dual loyalties,” here is an undeniable, demonstrable fact that no one engaged in the “dual loyalties” debate has managed to address: American Jews have the right to maintain dual citizenship, US and Israeli, to enter the Israeli military, and to serve under Israeli commanders. Those commanders have the authority to order those under their command (including American “Lone Soldiers,” as they’re called) to shoot at anyone deemed a threat under rules of engagement that cannot be questioned by anyone outside of the chain of command. The potential targets include Americans like me (or Rachel Corrie, or Tariq Abu Khdeir). No soldier has the right to refuse such an order. You get the order? You fire at will–to kill.

If an American serving under foreign command faces the prospect of shooting an American in a foreign country, exactly what description are we to give that situation but precisely one of dual loyalties? The soldier holding the weapon has one loyalty to a foreign commander, and one to the United States (or else to the principle of rights), which proscribes shooting a fellow citizen under questionable circumstances. How he resolves the dilemma is up to him, but you’d be out of touch with reality to deny that he’s in one. Is it really “racist” or “anti-Semitic” to identify this blatantly obvious fact? Apparently so.

If the New Jersey bill passes, my merely raising the preceding issue out loud, even as a question–iin the presence of someone who might report me to the police–makes me a criminal suspect, subject to arrest and prosecution. Though I teach at a private university, and the bill seems to apply only to public universities, the wording is extremely vague and ambiguous, and in case, even on the narrow interpretation of its scope, it implies that I lose my rights of free speech if I move to a public university or (perhaps) if I engage in a speech act while being present at a public university.

As someone who’s already been arrested on campus for “saying the wrong thing” (where the offended parties weren’t the usual left-wing snowflakes) this whole censorship thing is starting to get old pretty fast. If the passage of this bill wouldn’t mark a descent into fascism, with a rather large assist from the pro-Israel lobby, what would? If a constituency threatens to imprison you for exercises of free speech and academic freedom in the name of a sectarian state, are you really obliged to pretend that it’s not doing what it practically admits to be doing?

Dr Khawaja blogs at the always-excellent Policy of Truth.

Here is stuff on antisemitism at NOL. And on Palestine. And on free speech.

Nightcap

- Paying special attention to Israel’s recent home demolitions Michael Koplow, Ottomans & Zionists

- The political foundations of the German Federal Republic Jacob Van de Beeten, JHIBlog

- Taking a new, leftist look at Christianity in America Marilynne Robinson, New York Review of Books

- The best piece on Boris Johnson’s win I’ve yet read Alberto Mingardi, EconLog

Nightcap

- The divine right of the majority Pierre Lemieux, EconLog

- Overcoming the Mormon legacy on race Bruce Clark, Erasmus

- A sympathetic liberty Brent Orrell, Law & Liberty

- Free speech on the shoals of ideology Irfan Khawaja, Policy of Truth