Religious toleration is important to Britain’s historical self-image as a bastion of liberty against continental tyrants like Hitler, Napoleon, and Louis XIV.

But for much of the 18th century, Catholics in Britain were barred from government service, the army and navy, the law, and the universities. Formally, they were not allowed to inherit land or even marry with Catholic rites (though in practice there were well-recognized workarounds). Catholic priests faced life imprisonment and Catholic schools were illegal. When these laws were liberalized in 1778, this provoked the worst riot in early modern British history, the Gordon Riots.

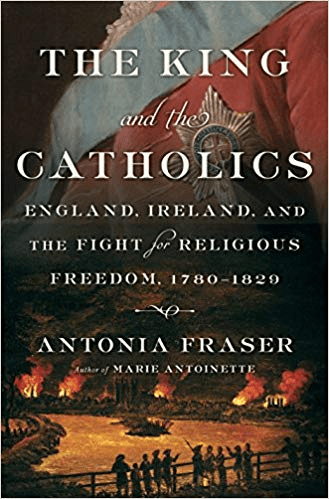

Frazer details the travails involved in passing Catholic Emancipation. The King and the Anglican establishment were strenuously opposed to liberalizing laws against Catholics. Despite the fact that he had Catholic friends, George III opposed emancipation because it violated his coronation oath to champion the Protestant religion.

Prime Minister William Pitt proposed emancipation in 1801 and offered to resign if the King disapproved. This prompted George III’s descent into paranoia or “madness”. Frazer notes that

“There had already been a bout of this madness in 1788 and 1789, with the younger George as temporary Regent. Whatever the actual illness from which he periodically suffered, it included among the symptoms an obessional quality which certain topics unquestionably aroused. Catholic Emancipation, that appalling prospect which would cause him to be damned for breaking his sacred vow, was prominent among them:

None of this is mentioned in the 1996 film, featuring Nigel Hawthrone, of course!

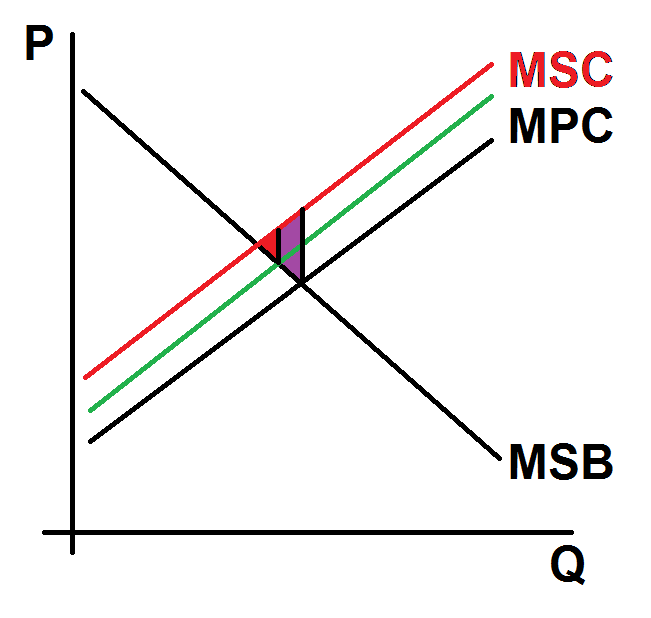

Why did Catholic emancipation provoke this reaction? The British state faced a crisis in the early 19th century. Most accounts focus on the French and Industrial Revolutions, which disrupted the existing social order and alarmed ruling elites. Religion is scarcely mentioned. Thus from a Marxian perspective, the Chartists and the passing of the Great Reform Act — which extended the franchise to property holders — represent the bourgeoisie, demanding political rights to match their economic power. Acemoglu and Robinson model the transition from oligarchy to democracy as a game theoretic problem, in which the threat of revolution from below obliged elites to grant democratic rights, in order to make the promise of economic redistribution credible. Neither spends much time on religion.

But an older historical tradition saw the Catholic Emancipation as among the key causes of the constitutional crisis that the British state underwent in the 1820s and 1830s. According to John Derry (1963, 95):

‘The Protestant ascendancy was part of the Constitution: one might say without it the Constitution would never have existed. The Coronation Oath pledged the monarch to maintain the Protestant religion as by law established, while the Act of Settlement ensured a Protestant succession. Both the landed gentry and the commercial classes — as well as the urban mob — believed that if the Protestant ascendancy went the gates were open to unimaginable horrors.”

To understand why this was so, and why Catholic Emancipation paved the way for further liberalization and the rise of liberal democracy, let us revisit the argument of Persecution & Toleration.

The significance of the Protestant Ascendency reflected Reformation England’s Church-State equilibrium. The treatment of Catholics is a canonical instance of what we call condition toleration. Catholicism per se was not illegal, but it was constrained, and these constraints were justified in political terms. Throughout the 17th century, Protestants feared a return of Catholicism which they associated with unrestrained autocratic rule. For Henry Capel MP in 1679:

“From popery came the notion of a standing army and arbitrary power. Formerly the Crown of Spain, and now France, supports the root of this popery amongst us; but lay popery flat and there’s an end of arbitrary government and power. It is a mere chimera without popery”.

It was on these grounds that the Whigs sought to disbar James II from the throne. After the Glorious Revolution, the Toleration Act of 1689 excluded both Catholics and atheists. And famously, the great advocate of religious toleration, John Locke rejected toleration for Catholics, as they were loyal to a foreign prince.

The religious aspect of the Glorious Revolution is neglected in the seminal accounts of it in the political economy and economic history literatures (i.e. here). But the Glorious Revolution settlement did not only guarantee the independence of Parliament from the Crown, it also safeguarded the political position of the Anglican Church by excluding Catholics from positions of power. In return, the Church of England remained the mainstay of state. As J.C.D. Clark (1985, 438) observed:

“The Church justified its established status on a principle of toleration — the toleration of other forms of Trinitarian Christian worship. It drew a sharp distinction between this and the admission of Nonconformists to political power.”

This was particularly significant in Ireland, where the Protestant Ascendency ensured the political and economic dominance of the Anglo-Scottish Protestant elite over the Catholic majority.

Now 18th century Britain was much less reliant on religion to legitimate political authority than prior regimes. As Jared Rubin argues, one consequence of the Reformation was a decline in the legitimizing power of religion; it was superseded by institutions such as parliaments, which represented economic rather than religious elites.

Other things had changed too. The ascendancy of the Church of England was seen as crucial to state security in post-Reformation England. But this was no longer the case by 1800. Following the initial break with Rome in the 16th century, these fears had not been groundless: Protestant Englishmen felt threatened by revanchist Catholic powers such as Spain and France and, in the Gunpowder plot, Catholic conspirators threatened the death of the king and the destruction of Parliament. The fact that the vast majority of Catholics were loyal to crown and country was not enough to alleviate Protestant fears, which occasionally erupted into persecutions, such as those that accompanied the Popish plot.

Following the French Revolution, however, Catholicism was no longer associated with an aggressively expansionist continental power. The old enemy was now secular. Catholic priests fleeing Revolutionary persecution found sanctuary in Britain. And by the 1820s there was a growing pragmatic and liberal opinion in favor of Catholic Emancipation. Lord Palmerston’s argument, as summarized by Frazer (p 157), was that

“. . . times had inevitably changed, and the argument to history could not be sustained: what if Nelson, Fox and Burke had all happened to be Catholics by birth. Would it have been right to deprive the nation of their services?”

Liberal Protestant clergy further argued that

“a Catholic layman who finds all the honor of the state open to him, will not, I think, run into treason and rebellion” (quoted from Frazer, 2018, 158).

Translated into the framework of Persecution & Toleration: the equilibrium had changed. Catholics no longer posed a political threat. The legitimatizing power of the Church of England was waning. Population growth, urbanization — particularly the rise of new urban centers — as well as immigration from Ireland, undermined the ideological hold of the Church of England.

Nevertheless, when the issue finally came to head in 1827–1829, it brought down the government. Catholic Emancipation was the Brexit of its day. When the pro-emancipation George Canning became Prime Minister, its leading opponents, the Duke of Wellington and Robert Peel resigned and the Tory party split into two. Canning then died. But the move towards liberalization now had momentum. Agitation in Ireland raised fears of revolution. In 1828 the Test Act was Repealed. Wellington and Peel reluctantly switched sides. 1829 Catholic Emancipation passed, despite the fact that King George IV disapproved of it.

Thus according to J.C.D. Clark’s insightful (though contested) account:

“As significant were the consequences of Emancipation: the belief that the sovereign would not resist massive constitutional change; and the profound schism which now rent the party of Wellington and Peel” (Clark, 1985, 536).

Catholic Emancipation thus set in motion a more general constitutional revolution. Both Whigs and Tory ultras who opposed Catholic Emancipation lost faith in the existing Parliamentary system. A fundamental pillar of society, the Church-State alliance, had been undermined. It was followed by the Great Reform Act and the rise of liberal democracy. In Clark’s word’s

“. . . the effect of the measures of 1828–1832 was to open the floodgates to a deluge of Whig or radical reform aimed against the characteristics institutions of the former social order . . . English society can point to few events which changed the pattern on the ground with the totality and the dynamism of 1776, 1789 or 1917: 1832 was not such an event. It was, however, decisive in many other ways, for it dealt a death blow to England’s old order. In the process, it produced what in other disciplines is called a ‘paradigm shift’”(Clark 1985, 555–556).