A few days ago, Bryan Caplan posted on his bet with Robert Murphy regarding inflation. Murphy predicted 10% inflation. He lost … big time. However, was he crazy to make that bet? In other words, what could explain Caplan’s victory?

Murphy was not alone in predicting this, I distinctly remember a podcast between Russ Roberts and Joshua Angrist on this where Roberts tells Angrist he expected high inflation back in 2008. Their claims were not indefensible. Central banks were engaging in quantitative easing and there was an important increase of the state money supply. There was a case to be made that inflation could surge.

It did not. Why?

In a tweet, Caplan tells me that monetary transmission channels are much more complex than they used to be and that the TIPS market knew this. Although I agree with both these points, it does not really explain why it did not materialize. I am going to propose two possibilities of which I am not fully convinced myself but whose possibility I cannot dismiss out of hand.

Imagine an AS-AD graph. If Murphy had been right, we should have seen aggregate demand stimulated to a point well above that of long-run equilibrium. Yet, its hard to see how quantitative easing did not somehow stimulate aggregate demand. Now, if aggregate demand was falling and that quantitative easing merely prevented it from falling, this is what would prove Murphy wrong. However, all of this assumes no movement of supply curves.

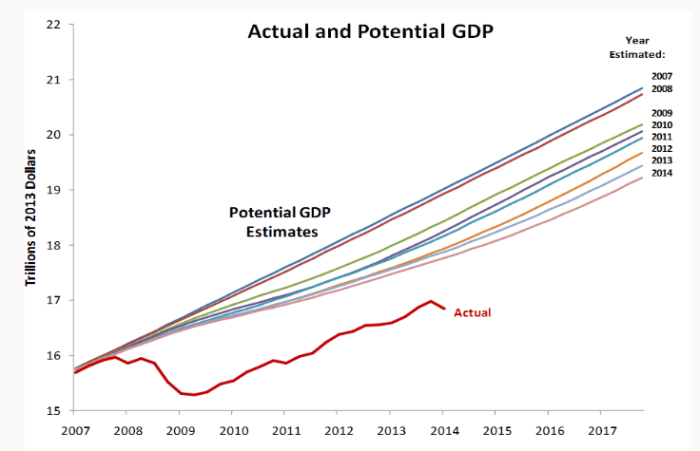

While AD falls and before monetary policy kicks in, imagine that policies are adopted that reduce the potential for growth and productivity improvement. In a way, this would be the argument brought forward by people like Casey Mulligan in work on labor supply and the “redistribution recession” and Edward Prescott and Ellen McGrattan who argue that, once you account for intangible capital, the real business cycle model is still in play (there was a TFP shock somehow). This case would mean that as AD fell, AS fell with it. I would find it hard to imagine that AS shifted left faster than AD. However, a relatively smaller fall of AS would lead to a strong recession without much deflation (which is what we have seen in this recession). Personally, I think there is some evidence for that. After all, we keep reducing the estimate for potential GDP everywhere while the policy uncertainty index proposed by Baker, Bloom and Davids shows a level change around 2008. Furthermore, there has been a wave – in my opinion of very harmful regulations – which would have created a maze of administrative costs to deal with (and whose burden is heavy according to Dawson and Seater in the Journal of Economic Growth). That could be one possibility that would explain why Murphy lost.

There is a second possibility worth considering (and one which I find more appealing): the role of financial regulations. Now, I may have been trained mostly by Real Business Cycle guys, but I do have a strong monetarist bent. I have always been convinced by the arguments of Steve Hanke and Tim Congdon (I especially link Congdon) and others that what you should care about is not M1 or M2, but “broad money”. As Hanke keeps pointing out, only a share of everything that we could qualify broadly as “money” is actually “state money”. The rest is “private money”. If a wave of financial regulations discourages banks to lend or incite them to keep greater reserves, this would be the equivalent of a drop of the money multiplier. If those regulations are enacted at the same time as monetary authorities are trying to offset a fall in aggregate demand, then the result depends on the relative impact of the regulations. The data for “broad money” (Hanke defines it as M4) shows convincingly that this is a potent contender. In that case, Murphy’s only error would have been to assume that the Federal Reserve’s policy took place with everything else being equal (which was not the case since everything seemed to be moving in confusing directions).

In the end, I think all of these explanations have value (a real shock, a banking regulation shock, an aggregate demand shock). In 25 years when economic historians such as myself will study the “Great Recession”, they will be forced to do like they do with Great Depression: tell a multifaceted story of intermingled causes and counter-effects for which no single statistical test can be designed. When cases like these emerge, it’s hard to tell what is happening and those who are willing to bet are daredevils.

P.S. I have seen the blog posts by Scott Sumner and Marcus Nunes regarding my NGO /NGDP claims. They make very valid points and I want to take decent time to address them, especially since I am using the blogging conversation as a tool to shape a working paper.

Vincent, AD is growing at a very “low” rate, consistent with too “low” inflation. Things have “twisted”, as I show here:

https://thefaintofheart.wordpress.com/2015/12/28/the-upside-down-economy-the-hare-chases-the-fox/

I agree with that statement which is why I posted the second explanation linked to the Hanke/Congdon explanation. I think that broad money changes described in the second figure provide strong justification. However, the “hare and the fox” story you tell does not have to be either “all AD” or “all AS à la Mulligan”. It is perfectly reasonable to believe that supply-side constraints are causing a non-negligible of the drop.

Suddenly emerging supply constraints? Some major piece of legislation (such as NIRA in the 1930s) can certainly have that effect, but if you don’t have something to point to, sudden shifts like that are much more plausibly demand-side.

Bob Murphy seems to have been caught with a perennial issue with Austrian school analysis — they really, really believe in markets and then suddenly really, really don’t. Caplan won by going with the market indicator, after all.

Being Australian, the key role of monetary policy in macroeconomic stability is perhaps more obvious. It seems, after all, very unlikely that Australia just happened to get the supply side smoothly right when everyone else wasn’t (especially when we had a proportionately bigger negative shock to export income than the US), or just happened to have a central bank that got the allegedly absolutely pivotal interest rate right for over 20 years when no one else did. It is much more plausible that its broad inflation targeting (“an average of 2-3% pa over the business cycle”) anchored both inflation and income expectations where narrow targeting central banks did the former but, alas, not the latter. Hence slightly higher inflation (2.6% since the target was announced) but way lower levels of monetary base. There was no reason for the demand to hold money to suddenly ramp up and, essentially, stay there.

Also, no interest on reserves and better prudential regulation. (Not done by the central bank, to start with, but a specifically tasked body–APRA Australian Prudential Regulatory Authority.)

Well technically there was quite a bit ofinflation in some areas of the economy, the stock market has seen tremendous inflation for example. Also one should not forget that low inflation or stability in prices maybe hidding the effect of monetary policy preventing what may have been deflation otherwise created by greater productivity. Mobile phone work tools, outsourcing websites, 3D scanning and printing and so many productivity enhancers should have resulted in a decrease in production costs and a generally lower CPI, yet we haven’t seen that effect on prices because inflation has simply voided the beneficial effects of these efficiencies, without appearing high. I personally think Murphy is right but we are simply not equipped to measure the real rate of inflation adequatly.

Jacques: there are also sources of price overestimation whether they are quality biases, substitution biases, outlet substitution biases

I should have included that Australia hasn’t had a technical recession (two consecutive quarters of negative economic growth) since 1993. We missed the GFC and the Great Recession and are still in the Great Moderation. But we live in the same trade-and-technology world as everyone else.

[…] Source: Was Murphy Foolish to Take Caplan’s Bet? | Notes On Liberty […]

[…] *Readers should note that I believe that monetary policy is, at present, too restrictive. However, I believe the culprit is not the Federal Reserve but financial regulations that restrict the circulation of “private money” (the other components of broad money found in divisia indices – see my blog post here). […]

Reblogged this on Utopia – you are standing in it!.